2021年农业银行秋季招聘试卷

题目总数:189

总分数:189

时间:不限时

第 1 题

单选题

中国农业银行的核心价值观是( )。

A.

诚信务实 开拓创新

B.

诚信立业 稳健行远

C.

诚信为本 稳健经营

D.

诚信服务 创新发展

第 2 题

单选题

中国农业银行的客户服务电话是( )。

A.

95599

B.

95588

C.

95533

D.

95566

第 3 题

单选题

以下( )是中国农业银行的英文简称。

A.

BOC

B.

ABC

C.

CCB

D.

ICBC

第 4 题

单选题

2016年,中国农业银行在美国《财富》杂志世界500强排名中,位列( )位。

A.

29

B.

19

C.

39

D.

49

第 5 题

单选题

以下哪一项不是中国农业银行的产品品牌名称?( )

A.

金钥匙

B.

金葵花

C.

金穗卡

D.

金益农

第 6 题

单选题

我国机构中,( )是社会主义协商民主的重要渠道和专门协商机构。

A.

人民政协

B.

国务院

C.

人大常委

D.

民政部

第 7 题

多选题

三农问题是关系到国计民生的根本性问题,三农是指( )。

第 8 题

单选题

习近平总书记在中共十九大报告中的民生和社会治理版块,提到优先发展教育事业,推动城乡义务教育一体化发展,高度重视农村义务教育,办好学前教育、特殊教育和网络教育,普及( )。

A.

义务教育

B.

大学生阶段教育

C.

高中阶段教育

D.

职业能力教育

第 9 题

多选题

改革开放之后,我们党对我国社会主义现代化建设作出战略安排,提出“三步走”战略目标。其中已经实现的目标是( )。

第 10 题

单选题

中国经济增长对世界经济增长贡献率超过( )。

A.

30%

B.

40%

C.

20%

D.

50%

第 11 题

单选题

中国经济目标目前保持中高速增长,国内生产总值增长至( )人民币,位居世界( )。

A.

八十万亿 第二

B.

七十万亿 第二

C.

百万亿 第一

D.

五十万亿 第三

第 12 题

多选题

全面从严治党,全面加强党的领导和党的建设,主要开展哪些教育活动?

第 13 题

单选题

为实现“两个一百年”的奋斗目标,综合分析国际国内形势和我国发展条件,从二〇二〇年到本世纪中叶分两个阶段安排。其中第一阶段的时间计划是( )。

A.

2020年至2035年

B.

2015年至2030年

C.

2018年至2030年

D.

2020年至2030年

第 14 题

单选题

中国共产党( )于2017年10月18日在北京召开。

A.

第十八届中央委员会

B.

第十九次全国代表大会

C.

第十九届六中全会

D.

第十八次全国代表大会

第 15 题

单选题

偿还期在超过一年的一个营业周期以上的债务称为( )。

A.

非借入负债

B.

周期性负债

C.

非流动负债

D.

投资性负债

第 16 题

单选题

按照每股收益大小判断资本结构的优劣,能够提高每股收益的资本结构是合理的资本及结构,其优化方法的标准叫法是( )

A.

每股利润最优差别法

B.

每股收益无差别点法

C.

资本成本比较法

D.

公司价值分析法

第 17 题

单选题

理财环境分为宏观理财环境和微观理财环境,以下属于微观理财环境的是( )。

A.

经济环境

B.

社会环境

C.

金融市场环境

D.

企业组织形式

第 18 题

单选题

下列关于抵押贷款适用范围的选项,不正确的是( )。

A.

必须是经工商行政管理部门核准注册,并按规定办理纳税登记和年检手续和企事业法人

B.

除国务院规定外,有限责任公司和股份有限公司对外股本权益性投资累计额未超过其净资产总额的50%

C.

按《银行企业信用的等级评价标准》核定,原则上信用等级必须为B级(含)以上

D.

借款人的经营和财务制度健全,主要经济和财务指标符合银行的要求

第 19 题

单选题

合伙事务的执行可以采取灵活的方式,只要全体合伙人同意即可。具体方式包括四种,但表述错误的是( )。

A.

由各合伙人分别单独执行合伙事务

B.

由部分合伙人委托数名合伙人执行合伙事务

C.

由全体合伙人共同执行,这种方式适合与合伙人数较少的合伙

D.

由一名合伙人执行合伙事务,即一名合伙人受托代表全体合伙人执行合伙事务

第 20 题

单选题

在公示催告期间届满后、除权判决作出前,又有利害关系人申报权利的,应该( )。

A.

判决终结公示催告

B.

仲裁终结公示催告

C.

裁定终结公示催告

D.

调解终结公示催告

第 21 题

单选题

清算人是指清算企业中执行清算事务以及对外代表者,个人独资企业清算的清算人,原则上是( )。

A.

负责人

B.

经理人

C.

管理人

D.

投资人

第 22 题

单选题

在《中华人民共和国劳动合同法》中,用人单位可以解除劳动合同的情形,不包括( )。

A.

严重违反用人单位的规章制度的

B.

被本企业警告,通报批评的

C.

在试用期间被证明不符合录用条件的

D.

被追究刑事责任的

第 23 题

单选题

让流程中各个层次上和各个群体中的人都参与分析和重新设计其工作方式的方法是( )。

A.

奥卡姆剃刀定律

B.

牛皮纸法

C.

华盛顿合作规律

D.

一条鞭法

第 24 题

单选题

对归于同一类型的人所说的话更信赖、更容易接受的效应称为( )。

A.

自己人效应

B.

金鱼缸效应

C.

近因效应

D.

霍桑效应

第 25 题

单选题

路径是从始点开始到终点的一条通路,网络图中有多条路径,其中关键路径是( )。

A.

所需时间最长的一条路径

B.

所需人员最多的一条路径

C.

所需计时最难的一条路径

D.

所需费用最多的一条路径

第 26 题

单选题

在对策论中,如果双方在选取策略时接受界限不清的约束,这就需要应用( )。

A.

随机对策论

B.

模糊对策论

C.

灰色对策论

D.

有限对策论

第 27 题

单选题

移动配置型是一种从员工相对岗位移动进行配置的类型,这种配置的具体表现形式大致有三种,其具体表现形式中不包含( )。

A.

调动

B.

降职

C.

辞退

D.

晋升

第 28 题

单选题

不是为保证现行决策的完满实现,而是为了有利于下一个环节的工作得以顺利开展的控制属于:

A.

预先控制

B.

前馈控制

C.

过程控制

D.

成果控制

第 29 题

单选题

沟通的过程是一个互动的过程,首先要解决的关键的心态问题是( )。

A.

诚信和宽容

B.

意志和决心

C.

信念和观点

D.

心情和情绪

第 30 题

单选题

渐进式变革的实现途径是( )。

A.

总体的修补和变换

B.

总体的重组和更新

C.

局部的重组和新建

D.

局部的修补和调整

第 31 题

单选题

关于Y式沟通的特点,以下选项中不正确的是( )。

A.

由于信息中间环节多,可能使上级不了解下级的真实情况

B.

信息传递和解决问题的速度较快,组织控制比较严格

C.

组织成员之间缺少直接和横向沟通,不能越级沟通

D.

包括节点在内,全体成员的满意程度比较高

第 32 题

单选题

Levy-Yeyati Sturzenegger的分类(LYS分类)是基于事实上的分类,它有三个分类变量,下列选项不属于其中的是( )。

A.

名义汇率的变动率

B.

汇率变化的变动率

C.

标准汇率的变动率

D.

国际储备的变动率

第 33 题

单选题

黄金期货合约交易具有杠杆性,即用少量资金推动大额交易,作为投资成本的定金,一般约为交易额的( )。

A.

50%左右

B.

30%左右

C.

70%左右

D.

10%左右

第 34 题

单选题

在中央银行资产负债表中,属于负债项目的是( )

A.

待收款项和固定资产

B.

中央银行发行债券

C.

财政部门的借款

D.

外汇储备

第 35 题

单选题

流动性陷阱(Liquidity Trap)是凯恩斯提出的一种假说,从宏观上看,一个国家的经济陷入流动性陷阱主要有三个特点,但不包括( )。

A.

货币需求利率弹性趋向无穷小,使得利率刺激投资和消费的杆杠作用失效

B.

货币需求利率弹性趋向于无限大,无论增加多少货币,都会被人们储存起来

C.

利率已经达到最低水平,名义利率水平大幅度下降,甚至为零利率或负利率

D.

整个宏观经济陷入严重的萧条中,需求不足,单凭市场的调节显得力不从心

第 36 题

单选题

在两种生产要素相互替代的过程中,普遍地存在这样一种现象:在维持产量不变的前提下,当一种生产要素的投入量不断增加时,每一单位的这种生产要素所能替代的另一种生产要素的数量是递减的,该规律是( )。

A.

边际技术替代率递减规律

B.

边际生产替代率递减规律

C.

边际产出替代率递减规律

D.

边际要素替代率递减规律

第 37 题

单选题

一国金融当局用以满足国际收支平衡和稳定汇率所需要的一切资产,称为( )。

A.

央行储备资产

B.

外汇储备资产

C.

平衡储备资产

D.

官方储备资产

第 38 题

单选题

名义粘性是指一般价格水平(工资水平)随着市场供求的变化而缓慢调整。名义粘性包括( )。

A.

价格粘性和工资粘性

B.

收益粘性和费用粘性

C.

成本粘性和报酬粘性

D.

需求粘性和利润粘性

第 39 题

单选题

国际借贷学说出现和盛行于金本位制时期,1861年,英国学者较为完整地提出,该学说认为:汇率决定于外汇市场上的( )。

A.

供求关系

B.

借贷关系

C.

主从关系

D.

贸易关系

第 40 题

单选题

为大客户提供个性化服务,为普通客户提供精准化服务,进而实现价格的差异化。该方式属于( )。

A.

宣传差异

B.

服务差异

C.

产品差异

D.

品牌差异

第 41 题

单选题

羽毛球比赛应重发球的情况是( )。

A.

发球时,球过网后挂在网上或停在网顶

B.

发球时,球拍拍框高于握拍手的手腕

C.

发球时,发球员和接发球员同时违例

D.

发球时,球拍拍框过腰

第 42 题

单选题

2010年12月,( )正式加入“金砖国家”合作机制,“金砖四国”成为“金砖五国”。

A.

南非

B.

俄罗斯

C.

巴西

D.

中国

第 43 题

单选题

由我国学者王大耜于1977年提出的“六届分类系统”,是在“五界分类系统”的基础上增加了( )。

A.

原核生物界

B.

原生生物界

C.

真菌界

D.

病毒界

第 44 题

单选题

天气预报中说的“湿度”是( )。

A.

绝对湿度

B.

相对湿度

C.

比较湿度

D.

气象湿度

第 45 题

单选题

国际经度会议决定,全世界按统一标准划分时区,实行分区计时。按这种办法,多少经度( )为一个时区。

A.

15°

B.

25°

C.

30°

D.

10°

第 46 题

单选题

体育运动中,运动员需要不时地擦一些白色的粉末,俗称“防滑粉”。那么,防滑粉的主要成分是( )。

A.

钙

B.

铁

C.

钠

D.

镁

第 47 题

单选题

“纳米盘”是网络存储的一种方式,但实际上,“纳米”是长度单位,一纳米等于( )分之一米。

A.

10万

B.

100亿

C.

100万

D.

10亿

第 48 题

单选题

以下不是我国邻国的是( )。

A.

阿富汗

B.

巴基斯坦

C.

印度

D.

伊拉克

第 49 题

单选题

以下救援原则中,不适当的是( )。

A.

先救“生”,后救“人”

B.

先救近,后救远

C.

先救轻伤员、青壮年和医务人员

D.

先救深埋的人员

第 50 题

单选题

现代生物起始于“生物大爆炸”时期,也就是寒武纪。那么,下列选项中生活于“生物大爆炸”时期的主要生物是( )。

A.

三叶虫

B.

始祖鸟

C.

银杏

D.

竹节石

第 51 题

单选题

关于管理信息系统(MIS)的成功实施,以下说法错误的是( )。

A.

使用合适的系统开发工具,它是直接影响管理信息系统实施的重要的技术因素

B.

建设管理信息系统专有的软件、硬件及网络环境,它是企业应用的前提和基石

C.

管理信息系统是一个数据加工厂,必须有企业准确、全面、规范的基础数据

D.

管理信息系统的功能设置和系统结构等均基于传统的组织机构和运行方式

第 52 题

单选题

J2EE应用程序是由组建构成的,下列J2EE组件的定义中不正确的是( )。

A.

JavaServlet和JavaServerPages(JSP)是web层组件

B.

JavaServlet和JavaServerPages(JSP)是应用层组件

C.

EnterpriseJavaBean(EJB)组件是运行在服务器端的业务组件

D.

应用客户端程序和applets是客户层组件

第 53 题

单选题

在数据库关系模型中,常用的查询操作是( )。

A.

增加

B.

删除

C.

修改

D.

连接

第 54 题

单选题

根据我国定制的《分布式数据库系统标准》,分布式数据库系统抽象为四层的结构模式,以下层次错误的是( )。

A.

全局概念层

B.

局部概念层

C.

全局内层

D.

全局外层

第 55 题

单选题

在C/C++语言中,运算对象必须都是整型数运算符的是( )。

A.

—

B.

&

C.

=

D.

%

第 56 题

单选题

数据字典是关于数据的信息的集合,也就是对数据流图中包含的所有元素定义的集合。数据字典的条目中,不包含( )。

A.

目录条目

B.

文件条目

C.

数据项条目

D.

数据流条目

第 57 题

单选题

软件定义网络(SoftwareDefinedNetwork,SDN)是由美国斯坦福大学提出的的一种新型网络创新架构,其核心技术是OpenFlow通过将网络设备控制面与数据面分离开来,从而实现了( )。

A.

网络结构的稳定控制

B.

网络数据的稳定控制

C.

网络拓扑的灵活控制

D.

网络流量的灵活控制

第 58 题

单选题

数据结构在计算机中的表示(映像)称为数据结构的物理(存储)结构,顺序存储结构的特点是( )。

A.

每个节点是由每个数据域和指针域组成

B.

逻辑上相邻的结点在物理上不必相邻

C.

插入、删除操作只需要改变节点中的指针

D.

用物理地址连续的存储单元依次存储逻辑上相邻的数据元素

第 59 题

单选题

SharePointWorkspace为企业用户提供基于微软SharePoint平台的方蝶工作流扩展。用户无需编写代码就可以快速、便捷地设计( )。

A.

文本文件和表格

B.

图形文件和图像文件

C.

任务表单和业务流程

D.

网页文件和操作流程

第 60 题

单选题

①政府财政补助一般占不到10%,而医疗服务价格又偏低,医院只能做大药品加成收入

②收入偏低的医生,获得价值回报的需求最终传导到药价上,“用贵药、开大处方”就成了难以遏制的偏好

③从医院的角度看,这是一种错位的“补偿”机制

④多数公立医院收入主要来自于3个渠道:政府财政补助、按项目收费的医疗收入和药品加成收入

⑤药品回扣问题的原因不难理解,主要是我国长期以来医药不分、以药养医

将以上5个句子重新排列,语序正确的是( )。

②收入偏低的医生,获得价值回报的需求最终传导到药价上,“用贵药、开大处方”就成了难以遏制的偏好

③从医院的角度看,这是一种错位的“补偿”机制

④多数公立医院收入主要来自于3个渠道:政府财政补助、按项目收费的医疗收入和药品加成收入

⑤药品回扣问题的原因不难理解,主要是我国长期以来医药不分、以药养医

将以上5个句子重新排列,语序正确的是( )。

A.

⑤③④①②

B.

③①②④⑤

C.

⑤④③①②

D.

③⑤④①②

第 61 题

单选题

(1)通过培训,柜员将不再单一处理简单的存取款业务,而是综合处理常见业务,让服务更________。

(2)报告以________的文风,务实的态度,全面阐释了人民法院维护公平正义历史使命,实现司法领域的公平正义所做的各项努力。

填入画横线部分最恰当的一项是:

(2)报告以________的文风,务实的态度,全面阐释了人民法院维护公平正义历史使命,实现司法领域的公平正义所做的各项努力。

填入画横线部分最恰当的一项是:

A.

简捷 俭朴

B.

简洁 俭朴

C.

简捷 简朴

D.

简洁 简朴

第 62 题

单选题

下乡调研时,发现不少乡镇存在“逆向调研”的怪现象,即:先写好调研报告,根据报告“________”问卷,再下基层找例证。这样一来,省时省力又省心,成了不少基层干部应付上级调研任务的“________”。

填入画横线部分最恰当的一项是:

填入画横线部分最恰当的一项是:

A.

量身定做 拿手本领

B.

量体裁衣 不传之秘

C.

闭门造车 独门秘诀

D.

凭空捏造 看家法宝

第 63 题

单选题

沙尘暴能有效地缓解酸雨。沙尘含有丰富的钙等碱性阳离子,这些外来的碱性沙尘能有效地中和酸雨。我国北方地区工业很发达,但除了个别城市以外很少有酸雨发生,这与北方常有沙尘天气有很大关系。沙尘暴还维系了海洋生态系统的循环与稳定,沙尘含有丰富的营养物,一些海域淤泥中的营养物约40%是由沙尘暴带入的,促进了该海域生物的繁茂。

下列说法中符合文意的一项是( )。

下列说法中符合文意的一项是( )。

A.

沙尘含有丰富的碱性阳离子,能中和酸雨

B.

沙尘含有丰富的营养物,能促进生物的繁荣

C.

所有海洋淤泥中的营养物约四成由沙尘暴带入

D.

北方工业发达城市常有酸雨发生

第 64 题

单选题

当大总统是一件事,拉黄包车也是一件事。事的名称,从俗人眼里看来,有高下;事的性质,从学理上解剖起来,并没有高下。只要当大总统的人,信得过我可以当大总统才去当,实实在在把总统当作一件正经事来做;拉黄包车的人,信得过我可以拉黄包车才去拉,实实在在把拉车当作一件正经事来做,便是人生合理的生活。

对这段文字的主旨概括最准确的是( )。

对这段文字的主旨概括最准确的是( )。

A.

事的名字有高下,事的性质没有高下

B.

当大总统和拉黄包车是两件不一样的事

C.

任何事实实在在来做就是合理的生活

D.

当大总统和拉黄包车是一件同样的事

第 65 题

单选题

(1)要按照时、度、效的要求,把握主要与次要、分清一般与重点,区分轻重缓急、坚持突出重点,运用________的宣传方式,实现宣传效果最大化。

(2)其实,抢红包只是一场________的春节游戏,在为单调的春节增色之余,我们更别忘了与亲人共享团圆的可贵。

填入画横线部分最恰当的一项是:

(2)其实,抢红包只是一场________的春节游戏,在为单调的春节增色之余,我们更别忘了与亲人共享团圆的可贵。

填入画横线部分最恰当的一项是:

A.

恰到好处 瑕不掩瑜

B.

恰到好处 瑕瑜互见

C.

恰如其分 瑕不掩瑜

D.

恰如其分 瑕瑜互见

第 66 题

单选题

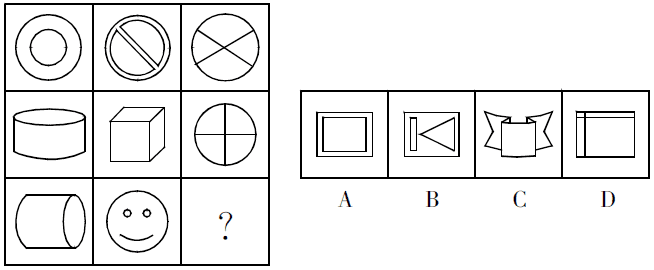

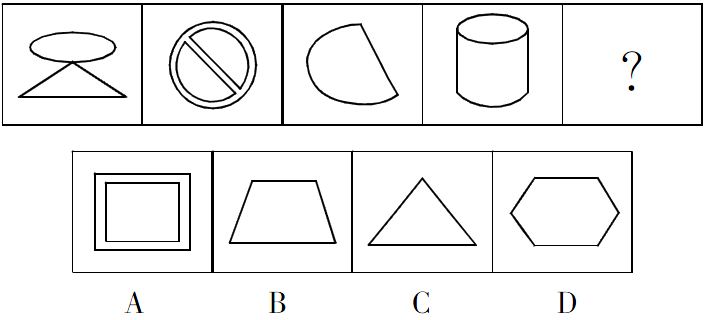

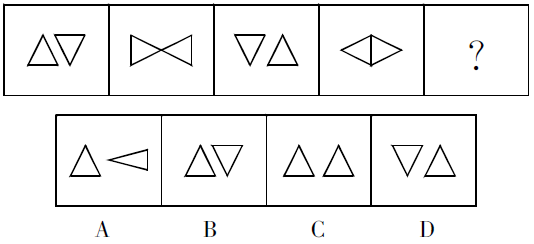

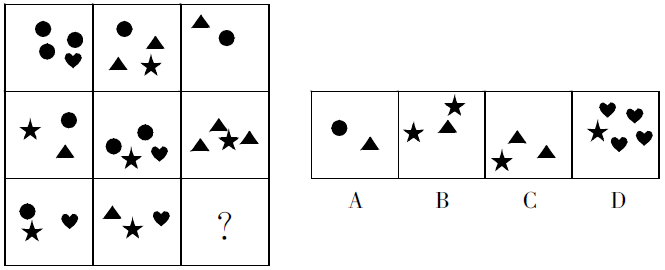

根据以下图形的规律,问号处应填入的是( )。

A.

A

B.

B

C.

C

D.

D

第 67 题

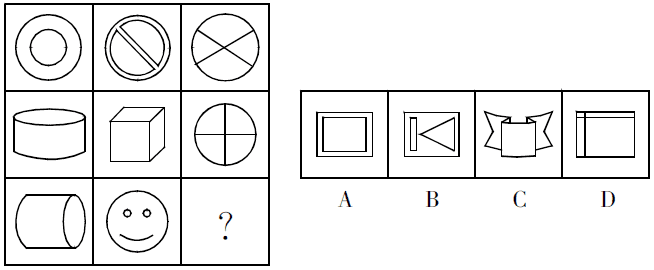

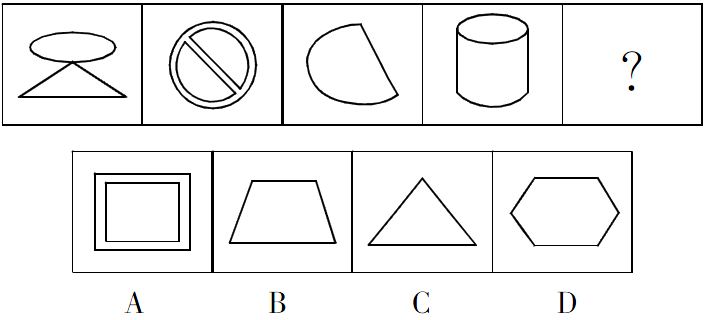

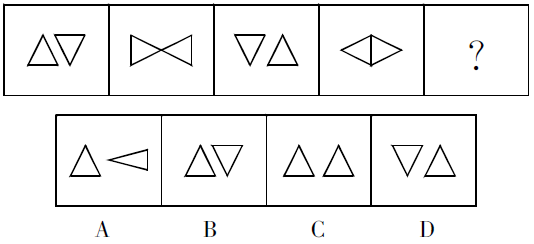

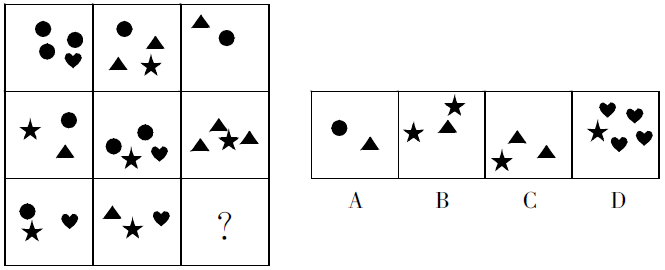

单选题

根据以下图形的规律,问号处应填入的是( )。

A.

A

B.

B

C.

C

D.

D

第 68 题

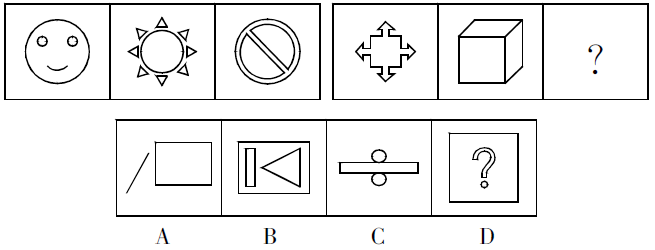

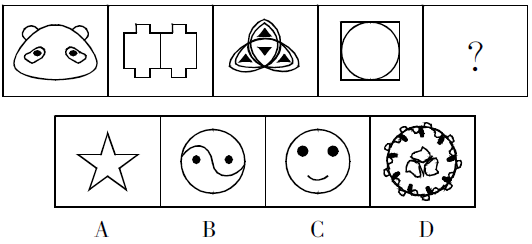

单选题

根据以下图形的规律,问号处应填入的是( )。

A.

A

B.

B

C.

C

D.

D

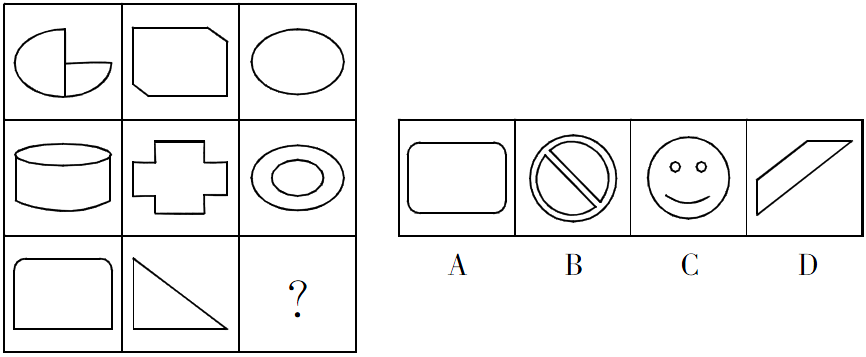

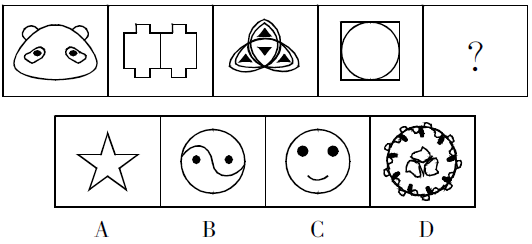

第 69 题

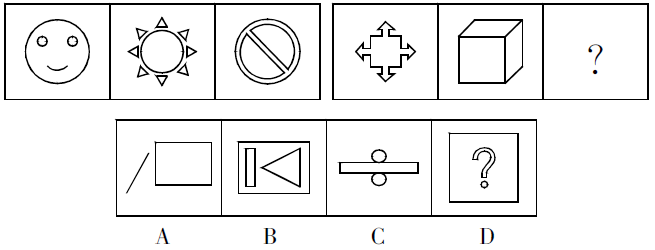

单选题

根据以下图形的规律,问号处应填入的是( )。

A.

A

B.

B

C.

C

D.

D

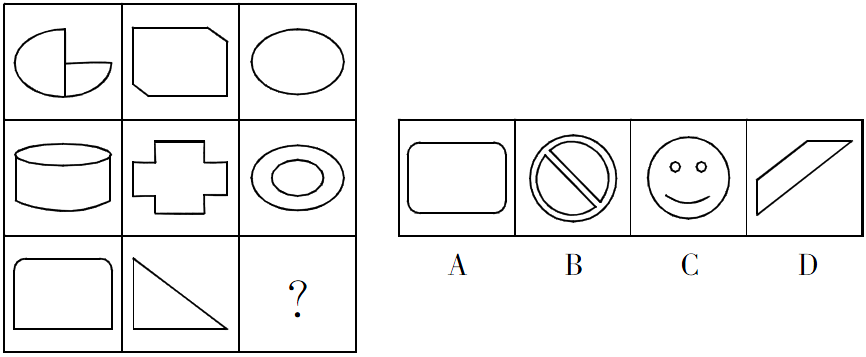

第 70 题

单选题

根据以下图形的规律,问号处应填入的是( )。

A.

A

B.

B

C.

C

D.

D

第 71 题

单选题

根据以下图形的规律,问号处应填入的是( )。

A.

A

B.

B

C.

C

D.

D

第 72 题

单选题

0, 2, 5, 10, 17, ( ), 41

A.

28

B.

27

C.

26

D.

25

第 73 题

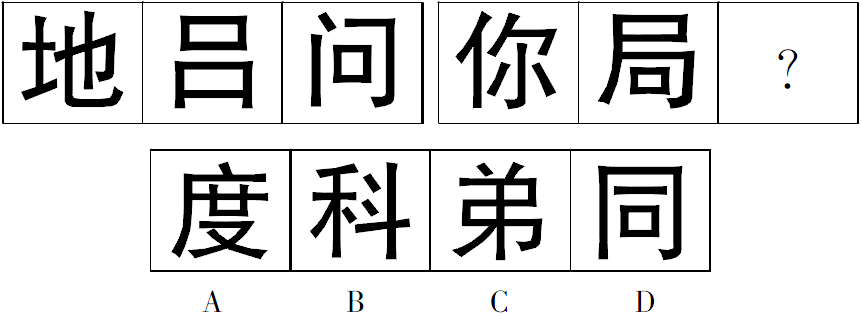

单选题

根据以下图形规律,问号处应填入的是?( )

A.

A

B.

B

C.

C

D.

D

第 74 题

单选题

1, 1, 3, 5, 11, 21, ( )

A.

49

B.

50

C.

43

D.

105

第 75 题

单选题

根据以下图形规律,问号处应填入的是?( )

A.

A

B.

B

C.

C

D.

D

第 76 题

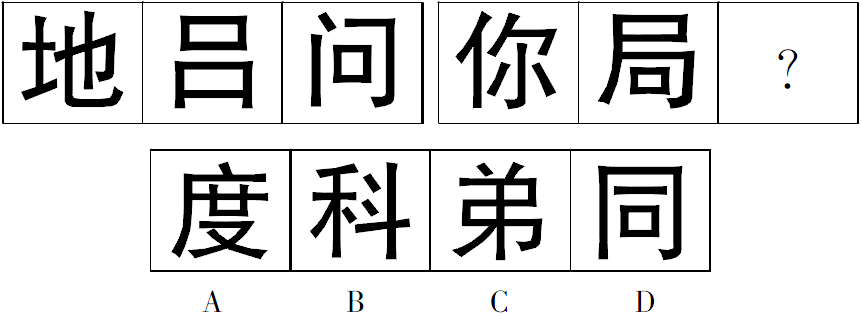

单选题

根据以下图形规律,问号处应填入的是?( )

A.

A

B.

B

C.

C

D.

D

第 77 题

单选题

根据以下图形规律,问号处应填入的是?( )

A.

A

B.

B

C.

C

D.

D

第 78 题

单选题

1, 1, 2, 6, 24, ( )

A.

120

B.

36

C.

144

D.

240

第 79 题

单选题

用1,2,3,4这四个数组成两个两位数,这两个两位数相乘乘积最小的是( )。

A.

408

B.

322

C.

426

D.

312

第 80 题

单选题

某贸易公司购进1 000吨货物进行销售,原计划每吨售价100元,预计3个月销售完毕,仓库租金每月需花费一定费用,因公司打算尽快回笼资金将这批货物降价10%进行销售,一个月就销售完毕,且利润比原计划增加4 000元。仓库租金为每月( )元。

A.

13 000

B.

7 000

C.

6 500

D.

14 000

第 81 题

单选题

某工厂要在规定的时间内生产一批设备,如果每天生产280台,可以提前3天完成;如果每天生产240台,就要再生产3天才能完成,问规定完成的时间是( )天。

A.

30

B.

33

C.

36

D.

39

第 82 题

单选题

李某假期去秦岭游玩,从甲山到乙山有3条路线,从乙山到丙山有4条路线,从丙山到丁山有2条路线,从甲山经过乙山、丙山到丁山不同走法共有( )种。

A.

24

B.

22

C.

28

D.

20

第 83 题

单选题

甲、乙、丙、丁4个数,每次去掉其中的一个算剩余3个数的平均数,得到的结果分别是166,168,170,171,这4个数的平均数是( )。

A.

168.75

B.

168.25

C.

170.25

D.

167.5

第 84 题

单选题

某高速公路铺设工地沿着公路建有五个卸沙场,每相邻两个之间的距离都是10千米,已知1号沙场存沙100吨,2号沙场存沙200吨,5号沙场存沙400吨,其余两个沙场是空的,现在要把所有的沙集中到一个沙场里,每吨沙运1千米花费1元,若要花费最少,则集中到( )号沙场。

A.

1

B.

2

C.

3

D.

5

第 85 题

单选题

一条河全长56千米,某船从上游到下游需要4小时,从下游返回上游需要7小时,则此船在静水中的速度为每小时( )千米。

A.

11

B.

10

C.

9

D.

8

第 86 题

单选题

四个业务部门,一部20人,二部21人,三部25人,四部34人,随机抽一人到外地,抽到一部的概率为( )。

A.

20%

B.

24%

C.

15%

D.

30%

第 87 题

单选题

2012年,爷爷的年龄是小明的6倍,2016年,爷爷的年龄是小明的5倍,那么2014年,爷爷和小明的年龄分别是多少岁?

A.

98,18

B.

96,16

C.

88,18

D.

86,16

第 88 题

单选题

公司材料库里甲材料的数量是乙材料的2倍,生产产品每天需要甲材料50吨,需要乙材料30吨,若干天后乙材料没有剩余时,甲材料还有180吨,仓库里原有甲材料( )吨。

A.

1080

B.

900

C.

540

D.

450

第 89 题

单选题

甲、乙两辆洒水车执行一条街道清扫任务。甲车单独清扫需要1小时,乙车单独清扫需要1.5小时,两车同时从该街道两端相向开出,相遇时甲车比乙车多清扫1.2千米,则该街道长度为( )千米。

A.

7

B.

6

C.

5

D.

4

第 90 题

单选题

某财政局要连续审核30个申请财政扶持的项目,如果要求每天安排审核的项目个数互不相等且不为零,则审核完这些项目最多需要( )天。

A.

9

B.

10

C.

8

D.

7

第 91 题

单选题

在浓度为45%的糖水中加入16千克浓度为20%的糖水,混合之后的糖水浓度为25%,则现在有糖水( )千克。

A.

18

B.

20

C.

24

D.

28

第 92 题

单选题

( +

+ +

+ )+(

)+( +

+ +

+ +

+ )+(

)+( +

+ +

+ +

+ +

+ )+……+(

)+……+( +

+ +

+ +……+

+……+ )=( )。

)=( )。

+

+ +

+ )+(

)+( +

+ +

+ +

+ )+(

)+( +

+ +

+ +

+ +

+ )+……+(

)+……+( +

+ +

+ +……+

+……+ )=( )。

)=( )。

A.

B.

26

C.

15

D.

第 93 题

单选题

999×22+1 000×20+1 001×21=( )。

A.

62 999

B.

63 001

C.

62 998

D.

63 002

第 94 题

单选题

1234×9999+4321×10001=( )。

A.

55565007

B.

55535207

C.

55546917

D.

55553087

第 95 题

单选题

1+22+333+........+999999999+1111111111+......+99....99,该算式一共27项,其结果的百位数字为( )。

A.

4

B.

5

C.

6

D.

7

第 96 题

单选题

19×199+199×1999+1999×19999=( )。

A.

37299563

B.

40379583

C.

41529543

D.

45618713

第 97 题

单选题

22001+32002+52003的尾数是( )。

A.

6

B.

5

C.

3

D.

2

第 98 题

单选题

=( )。

=( )。

A.

B.

C.

1

D.

第 99 题

单选题

2 006×1 997-1 996×1 995=( )。

A.

15 232

B.

23 962

C.

33 162

D.

42 652

第 100 题

单选题

78×7 979-79×7 878=( )。

A.

1

B.

-1

C.

101

D.

0

第 101 题

单选题

9×13×27×31×49×54=( )。

A.

293745152

B.

261213206

C.

249950131

D.

259120134

第 102 题

单选题

2016×20152015-2014×20162016=( )。

A.

20132013

B.

20142014

C.

20152015

D.

20162016

第 103 题

单选题

1253823+6403924+2704025+8004126+1004227=( )。

A.

18816255

B.

19080755

C.

19240115

D.

19370125

第 104 题

单选题

1×2+2×3+3×4+.......+19×20+20×21=( )。

A.

2920

B.

3080

C.

2870

D.

3150

第 105 题

单选题

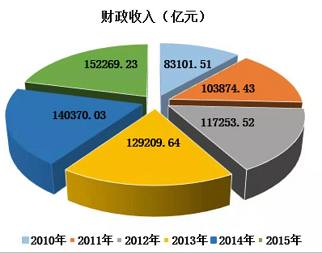

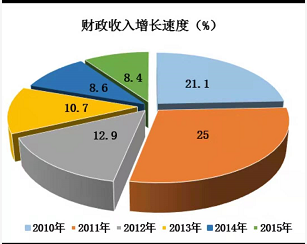

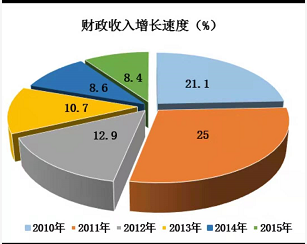

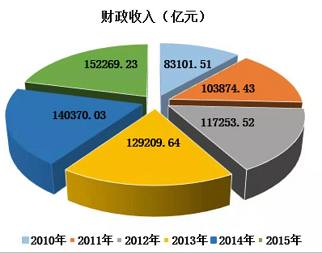

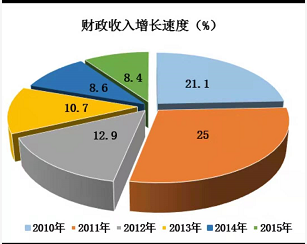

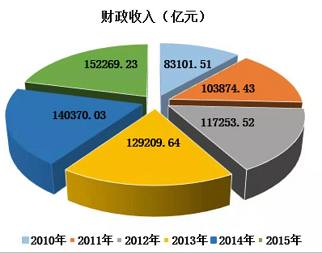

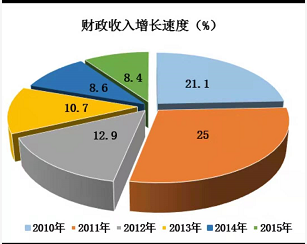

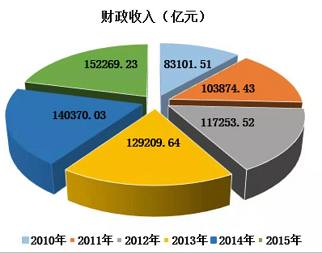

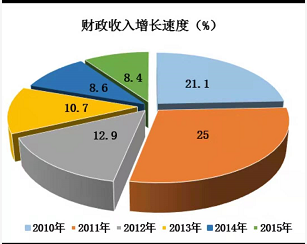

财政收入增速最快的一年财政收入( )亿元。

A.

117 253.52

B.

140 370.03

C.

103 874.43

D.

152 269.23

第 106 题

单选题

与上一年相比,财政收入增速下降近五成的年份,财政收入比上年度增加( )亿元。

A.

13 379.09

B.

11 956.12

C.

20 772.92

D.

11 899.20

第 107 题

单选题

2015年财政收入与2010年相比增加了( )%。

A.

5.8

B.

25

C.

83.23

D.

83.8

第 108 题

单选题

所有财政收入增速介于10%和20%之间的年份,财政收入的总和是( )亿元。

A.

117 253.52

B.

329 564.67

C.

269 579.67

D.

246 463.16

第 109 题

单选题

下列选项中,表述错误的是( )。

A.

2015年财政收入与2011年相比增加近五成

B.

2011年,我国财政收入突破10万亿元

C.

2010—2015年,我国财政收入增速一直稳中有升

D.

2010—2015年,我国财政收入一直稳中有升

第 110 题

单选题

Science relies on hard evidence and will _____ nothing as true until it is proved by the scientific method.

A.

tackle

B.

scorn

C.

accept

D.

avoid

第 111 题

单选题

But at the same time, 77 percent of moms and dads _______ that the Web is crucial to learning, and an overwhelming 91 percent admit that it helps their kids explore things they’re passionate about.

A.

recognize

B.

announce

C.

distinguish

D.

assert

第 112 题

单选题

God by definition is supernatural and cannot, in principle, be _________ by science which deals exclusively with the natural world.

A.

investigated

B.

responded

C.

suspected

D.

stated

第 113 题

单选题

Chinese table cloth is _________ for its fine quality, exquisite workmanship and compelling style.

A.

distinctive

B.

nominated

C.

notable

D.

deviated

第 114 题

单选题

Sometimes that stress is relieved ________ in the form of a large earthquake.

A.

gradually

B.

steadily

C.

slowly

D.

suddenly

第 115 题

单选题

Israeli officials blame the settlers, saying they have refused to ________ with the government.

A.

direct

B.

cooperate

C.

comment

D.

remind

第 116 题

单选题

Today, China’s massive industrialization and ________ for cars have made it dependent on oil imported from the Mideast and Africa.

A.

mania

B.

nostalgia

C.

substitution

D.

anecdote

第 117 题

单选题

The snake farmers said they had been bitten, some by deadly snakes, and were saved by ______ of anti-venom medicine.

A.

injection

B.

producing

C.

infection

D.

consuming

第 118 题

单选题

Despite his Catholic background, Kennedy also became a strong advocate of ________ rights and later, a supporter of same-sex marriage.

A.

autonomy

B.

removal

C.

abortion

D.

waste

第 119 题

单选题

Lawyers have questioned the _______ of the ban on political rallies, but officials continue to insist they are more interested in ensuring public safety than stifling political dissent.

A.

qualification

B.

legality

C.

importance

D.

extension

第 120 题

单选题

A congenital lip deformity caused him to speak in a nasal, almost _______ whisper.

A.

unbearable

B.

unintelligible

C.

intolerable

D.

unpleasant

第 121 题

单选题

The mobility of cell phones means you can be anywhere and have the ________, or should I say the convenience, of a phone.

A.

accompaniment

B.

necessity

C.

must

D.

conclusion

第 122 题

单选题

We also had to collect immense amounts of historical data and ________ satellites to monitor the ocean-atmosphere system.

A.

make up

B.

devote to

C.

set up

D.

invest in

第 123 题

单选题

The differences _______ the difficulty of understanding what is happening to the economy at present.

A.

understate

B.

criticize

C.

suggest

D.

underline

第 124 题

单选题

Gun use has an additional tragic dimension when compared with tobacco, namely the high incidence of ______ deaths, particularly among the young.

A.

romantic

B.

doomed

C.

interesting

D.

unintentional

第 125 题

单选题

Meanwhile, you can collect special stickers that either open up secrets or launch _______ powerful attacks.

A.

surprisingly

B.

merely

C.

devastatingly

D.

consequently

第 126 题

单选题

He said the UK government would allow the island to determine its own ________ and democracy.

A.

enhancement

B.

equality

C.

development

D.

agreement

第 127 题

单选题

Dr. Urey, American physical chemist, did not convert to just any new idea, but accepted a model that _______ reality better.

A.

attached

B.

matched

C.

added

D.

designed

第 128 题

单选题

Much of Canada’s forestry ________ goes towards making pulp and paper.

A.

production

B.

introduction

C.

orientation

D.

multiplication

第 129 题

单选题

The more diverse knowledge one understands and actively absorbs, the greater the probability of finding useful and _______ discoveries.

A.

narrative

B.

conventional

C.

novel

D.

rebellious

第 130 题

单选题

And they must be swifter to embrace new technology, from the excitement of the Internet to the ________ of the telephone.

A.

pressure

B.

dullness

C.

restrictions

D.

tension

第 131 题

单选题

Recruiting the right people _______ looking for individuals with diverse skills from a range of backgrounds.

A.

is involved

B.

involves

C.

is

D.

are

第 132 题

单选题

Many species are in peril of extinction because of our destruction of their natural _____.

A.

favor

B.

hoop

C.

habitat

D.

circle

第 133 题

单选题

Before starting to write effect analysis essay, one should ______ between cause and effect.

A.

disguise

B.

distinguish

C.

diminish

D.

derive

第 134 题

单选题

In addition to bending back and forth and swaying sideways, buildings can ______, and these various motions can reinforce one another.

A.

twist

B.

conceive

C.

imagine

D.

describe

第 135 题

单选题

The rise of the _______ industry in Georgia was a significant historical development with a profound effect on the state’s textile manufacture.

A.

fashion

B.

filming

C.

fiber

D.

fabric

第 136 题

单选题

Think of a dance floor, which is designed to dampen vibrations and limit the _______ dancers could do to their limbs.

A.

dilemma

B.

problem

C.

trouble

D.

damage

第 137 题

单选题

The task now for Scotland is to win their remaining ______ matches before the competition starts.

A.

fashionable

B.

stylish

C.

trendy

D.

friendly

第 138 题

单选题

They are not allowed contact with the outside world or any substances that haven’t been fully ______.

A.

packed

B.

tidy

C.

infected

D.

sanitized

第 139 题

单选题

If you ______ the trigger of a gun really fast, it doesn’t fire any faster or harder than if you just squeezed it gently.

A.

squeeze

B.

condense

C.

obtain

D.

lost

第 140 题

单选题

Bilateral relations have entered a new stage of development both in terms of ______ and breadth.

A.

profundity

B.

dimension

C.

implication

D.

innovation

第 141 题

单选题

Already, the ______ of Homeland Security has handed out hundreds of millions of dollars to fund more surveillance cameras in cities across the nation.

A.

department

B.

sanction

C.

center

D.

section

第 142 题

单选题

This nomination will take two months, after which the commission will make its _____ to the president.

A.

promotion

B.

motivation

C.

accommodation

D.

recommendation

第 143 题

单选题

______ often occurs because we lack self confidence and doubt our abilities.

A.

Interference

B.

Indecisiveness

C.

Carelessness

D.

Procrastination

第 144 题

单选题

______ your child will leave home to lead her own life as a fully independent adult.

A.

Eventually

B.

Quickly

C.

Unanimously

D.

Uncertainly

第 145 题

单选题

Players must not ______ raise the ball from a hit except for a shot at goal.

A.

intentionally

B.

shyly

C.

timidly

D.

unwillingly

第 146 题

单选题

CFCs were banned when world leaders signed ______ called the Montreal Protocol in 1987.

A.

a contact

B.

contact

C.

agreement

D.

an agreement

第 147 题

单选题

Many of those that are prosecuted and sentenced and end ______ in a jail are subsequently freed or simply walk out the door as there are prisons in Congo that simply do not have doors.

A.

down

B.

up

C.

off

D.

beyond

第 148 题

单选题

Should UK depositors lose money, the government would have to decide whether to _____ for it directly.

A.

overlook

B.

notify

C.

compensate

D.

trigger

第 149 题

单选题

She got her degree successfully as her university _______ was on Marina Tsvetacva, a poet then in deep official disfavor.

A.

dissertation

B.

paradox

C.

hypothesis

D.

conclusion

第 150 题

单选题

I knew almost everyone I needed to know no matter whether they _______ goodness or badness.

A.

exhibited

B.

hid

C.

boasted

D.

proved

第 151 题

单选题

She and another woman were convicted in 2005 of tax _______ but were released under an amnesty.

A.

erosion

B.

enclosure

C.

exception

D.

evasion

第 152 题

单选题

How quickly they accomplish this transfer depends not only on how soon the ants agree on best available site but also on how quickly they can ______ there.

A.

prefer

B.

choose

C.

migrate

D.

stay

第 153 题

单选题

How are we to develop new technology if we can’t study current technology to figure out how to _______ it

A.

cause

B.

conceal

C.

rest

D.

improve

第 154 题

单选题

In sub-Saharan Africa today, for instance, gross investment ______ for roughly 15% of national income.

A.

constitutes

B.

makes

C.

accounts

D.

estimates

第 155 题

单选题

According to our research, Best Buy in China was perceived as being too expensive, with many of their products priced higher than in local markets. Why buy a Sony DVD player or Nokia phone at Best Buy when you can pay less for the exact same product at a local store Consumers will only be willing to pay more, like at the Apple stores, if they are buying something they cannot get elsewhere.

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

What is the most likely content the speaker discussed before these three paragraphs

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

What is the most likely content the speaker discussed before these three paragraphs

A.

Chinese local retailers’ reason for success.

B.

The development of retail industry in China.

C.

Best Buy’s failure in China.

D.

Overseas retailers’ struggle in the Chinese market.

第 156 题

单选题

According to our research, Best Buy in China was perceived as being too expensive, with many of their products priced higher than in local markets. Why buy a Sony DVD player or Nokia phone at Best Buy when you can pay less for the exact same product at a local store Consumers will only be willing to pay more, like at the Apple stores, if they are buying something they cannot get elsewhere.

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

What Western retailers can do to stay competitive

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

What Western retailers can do to stay competitive

A.

Be aware of the importance of location choice.

B.

Localize their product selection.

C.

Better understand the evolving Chinese consumer preferences.

D.

All above.

第 157 题

单选题

According to our research, Best Buy in China was perceived as being too expensive, with many of their products priced higher than in local markets. Why buy a Sony DVD player or Nokia phone at Best Buy when you can pay less for the exact same product at a local store Consumers will only be willing to pay more, like at the Apple stores, if they are buying something they cannot get elsewhere.

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

What can be inferred from the third paragraph

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

What can be inferred from the third paragraph

A.

Large flagship stores are unpopular in China.

B.

A government ban on free shopping bags has dampened Chinese buyers’ enthusiasm.

C.

Shopping at neighborhood stores are more of Chinese consumers’ shopping habit.

D.

Americans do not like small, conveniently located retail outlets.

第 158 题

单选题

According to our research, Best Buy in China was perceived as being too expensive, with many of their products priced higher than in local markets. Why buy a Sony DVD player or Nokia phone at Best Buy when you can pay less for the exact same product at a local store Consumers will only be willing to pay more, like at the Apple stores, if they are buying something they cannot get elsewhere.

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

The underlined part in the second paragraph means ______.

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

The underlined part in the second paragraph means ______.

A.

condemnable

B.

common

C.

illegal

D.

rife

第 159 题

单选题

According to our research, Best Buy in China was perceived as being too expensive, with many of their products priced higher than in local markets. Why buy a Sony DVD player or Nokia phone at Best Buy when you can pay less for the exact same product at a local store Consumers will only be willing to pay more, like at the Apple stores, if they are buying something they cannot get elsewhere.

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

Which of the following statements is not true

While scales of economy have allowed big chain stores in America to offer cheaper prices than niche players, local retailers in China are able to undercut prices because they pay less in salaries, benefits, rent and electricity. Rampant piracy in China also means local computers shops are willing to install counterfeit Microsoft software in products, which makes it more appealing for customers.

Apart from failing to differentiate its product lines, Best Buy also made the mistake of focusing on building large flagship stores, like in the U.S., rather than smaller, conveniently located retail outlets. China may have one of the highest car adoption rates in the world, but its perennial traffic congestions and lack of parking mean consumers often prefer to shop closer to their homes. A government ban on free shopping bags has also resulted in consumers shopping more often, but buying less each time, further fueling the popularity of neighborhood stores.

Which of the following statements is not true

A.

Western retailers cannot succeed in Chinese market.

B.

To start a successful business, a better understanding of consumer preferences is important.

C.

Chinese market needs more regulations.

D.

In China, owning a car does not necessarily mean efficient travel.

第 160 题

单选题

2014 has been a landmark year for Alibaba. Just last week, the Chinese e-commerce juggernaut set a world-record selling US $9.3 billion worth of goods in 24 hours on Singles Day. A few months back, Alibaba claimed the title of the world’s biggest IPO, raising US $25 billion on the NYSE. Things will only get bigger for Alibaba.

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

What is this article mainly about

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

What is this article mainly about

A.

The introduction of Alibaba.

B.

Alibaba’s Alipay and Taobao marketplace expand into Australia.

C.

Alibaba’s new business strategy.

D.

Alibaba’s acquisition of Australian local companies.

第 161 题

单选题

2014 has been a landmark year for Alibaba. Just last week, the Chinese e-commerce juggernaut set a world-record selling US $9.3 billion worth of goods in 24 hours on Singles Day. A few months back, Alibaba claimed the title of the world’s biggest IPO, raising US $25 billion on the NYSE. Things will only get bigger for Alibaba.

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

What did Alibaba do after sign-off of China-Australia Free Trade Agreement

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

What did Alibaba do after sign-off of China-Australia Free Trade Agreement

A.

It announced that they would bring more Chinese goods into the Australian market.

B.

It announced that they would promote the trade between China and Australia.

C.

It announced that they would import more Australian products into China.

D.

It announced that they would introduce more Australian products to Chinese online consumers.

第 162 题

单选题

2014 has been a landmark year for Alibaba. Just last week, the Chinese e-commerce juggernaut set a world-record selling US $9.3 billion worth of goods in 24 hours on Singles Day. A few months back, Alibaba claimed the title of the world’s biggest IPO, raising US $25 billion on the NYSE. Things will only get bigger for Alibaba.

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

How many transactions does Alibaba clear every day without using Alipay Wallet mobile app

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

How many transactions does Alibaba clear every day without using Alipay Wallet mobile app

A.

80 million.

B.

40 million.

C.

35 million.

D.

780 million.

第 163 题

单选题

2014 has been a landmark year for Alibaba. Just last week, the Chinese e-commerce juggernaut set a world-record selling US $9.3 billion worth of goods in 24 hours on Singles Day. A few months back, Alibaba claimed the title of the world’s biggest IPO, raising US $25 billion on the NYSE. Things will only get bigger for Alibaba.

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

It can be inferred from the article that ______.

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

It can be inferred from the article that ______.

A.

After entering into Australia, Alibaba will try to expand to the U.S.

B.

Alibaba has established cooperation with Australia Post.

C.

Alibaba would open chain stores after entering into Australia.

D.

Alibaba’s world-record of selling US $9.3 billion worth of goods in 24 hours on Singles Day has helped its initial public offering.

第 164 题

单选题

2014 has been a landmark year for Alibaba. Just last week, the Chinese e-commerce juggernaut set a world-record selling US $9.3 billion worth of goods in 24 hours on Singles Day. A few months back, Alibaba claimed the title of the world’s biggest IPO, raising US $25 billion on the NYSE. Things will only get bigger for Alibaba.

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

According to the article, which of the following is NOT correct about Alibaba

On the back of the historic signing of the China-Australia Free Trade Agreement yesterday, Alibaba announced in Melbourne their continued commitment to bringing Australian products, brands and businesses closer to China’s online consumers via its Alipay payment platform and Taobao Marketplace.

Alipay is the largest online payment service provider in China. With more than 800 million Chinese accounts, Alipay is already the biggest mobile payment processor in the world. It clears 80 million transactions per day, including 45 million transactions through its Alipay Wallet mobile app and processed US $780 billion worth of transactions in the year ended June 30. Alipay is one of six financial services entities that will fall under the umbrella of Ant Financial Services Group, a rebranding of Alipay Financial Services. There are plans to take this money making machine public too.

Alipay Australia has been established as a local entity that will work with its joint venture partner, Paybang to help Australian businesses and merchants access Alipay’s cross-border payment solutions. Alipay has also been working with Australia Post to sell, distribute and promote the Alipay Purchase Card across 4,400 retail outlets for Australian shoppers to use on the Tmall.com and Taobao Marketplace platforms.

Alipay’s extension into Australia follows its move into the U.S. with the launch of its ePay payment program, which handles everything from payment processing and currency translation for U.S. retailers.

According to the article, which of the following is NOT correct about Alibaba

A.

It is the world’s biggest IPO.

B.

It has sold more than US $9 billion worth of goods in 24 hours on Singles Day.

C.

It is the largest online payment service provider in China.

D.

It has a strong social responsibility.

第 165 题

单选题

As a startup founder, my daily tasks include everything from long-term strategic planning to approving team outings and company culture initiatives. Day after day, things inevitably come up that need to get handled ASAP. But I’ve also learned that if you don’t have a strategy for making time for those bigger ambitions and your truly lofty goals, they’ll simply never get done. And that means you won’t make the progress that’s really going to move your business forward.

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

What is the article mainly about

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

What is the article mainly about

A.

How to prevent distractions and focus on big issues.

B.

How to win competitions and get promotions.

C.

How to manage your time well.

D.

How to overcome different challenges in the office.

第 166 题

单选题

As a startup founder, my daily tasks include everything from long-term strategic planning to approving team outings and company culture initiatives. Day after day, things inevitably come up that need to get handled ASAP. But I’ve also learned that if you don’t have a strategy for making time for those bigger ambitions and your truly lofty goals, they’ll simply never get done. And that means you won’t make the progress that’s really going to move your business forward.

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

The word “wanes” in Paragraph 2 is closest in meaning to ______.

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

The word “wanes” in Paragraph 2 is closest in meaning to ______.

A.

disappear

B.

diminish

C.

increase

D.

peak

第 167 题

单选题

As a startup founder, my daily tasks include everything from long-term strategic planning to approving team outings and company culture initiatives. Day after day, things inevitably come up that need to get handled ASAP. But I’ve also learned that if you don’t have a strategy for making time for those bigger ambitions and your truly lofty goals, they’ll simply never get done. And that means you won’t make the progress that’s really going to move your business forward.

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

According to Paragraph 2, which of the following is the “chunk of time” the author is talking about

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

According to Paragraph 2, which of the following is the “chunk of time” the author is talking about

A.

Bright and early in the morning.

B.

Late at night.

C.

When you are most focused.

D.

When there are no distractions.

第 168 题

单选题

As a startup founder, my daily tasks include everything from long-term strategic planning to approving team outings and company culture initiatives. Day after day, things inevitably come up that need to get handled ASAP. But I’ve also learned that if you don’t have a strategy for making time for those bigger ambitions and your truly lofty goals, they’ll simply never get done. And that means you won’t make the progress that’s really going to move your business forward.

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

What can be inferred from Paragraph 3

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

What can be inferred from Paragraph 3

A.

Sometimes we have to decline colleagues’ requests.

B.

People in the office love helping others.

C.

You have to be readily available in the office.

D.

People cannot work in a vacuum.

第 169 题

单选题

As a startup founder, my daily tasks include everything from long-term strategic planning to approving team outings and company culture initiatives. Day after day, things inevitably come up that need to get handled ASAP. But I’ve also learned that if you don’t have a strategy for making time for those bigger ambitions and your truly lofty goals, they’ll simply never get done. And that means you won’t make the progress that’s really going to move your business forward.

1.FIND YOUR MOST PRODUCTIVE TIME

Face it: You aren’t cranking out work at absolute peak productivity for the entire day. Instead, there are likely certain times when you’re at your most focused and other times when your energy wanes. That’s normal. Maybe for you, it’s bright and early in the morning, before anyone else arrives in the office, when you do your best work. Whenever it is, identify that chunk of time even if it’s only an hour! when you feel your most productive, and then reserve it on your calendar like you would do any other important meeting. You need to protect this block of time from intrusion — it isn’t optional. That way you’re guaranteed to have a regular, designated period when you can at least get started on those bigger to-dos.

2. CREATE PHYSICAL BARRIERS

Nobody works in a vacuum. We all have to collaborate with others to some degree or another. And it’s the people we work closest with whom we tend to put first — we want to be readily available if they need our help. But there are times you need to tune out the distractions and focus if you’re going to get any meaningful work done.

One of the most effective methods I’ve found is to put physical barriers between us. I’ll work from a conference room or even from home on occasion in order to get some literal space from people needing “just one quick thing.”

What may the author discuss later

1.FIND YOUR MOST PRODUCTIVE TIME