2015年工商银行秋季招聘试卷

题目总数:143

总分数:143

时间:不限时

第 1 题

单选题

IC网络有限公司(以下简称“IC网络”)是一家做垂直电商的公司,目前与诺鑫银行的合作仅限于现金结算业务。近期,IC网络有意将业务延伸至互联网金融领域,行里将拓展与IC网络业务合作的业务交给了陈之,由老员工吴勉指导。

吴勉和陈之讨论了对IC网络的业务拓展,他们认为第一步需要对B2C的市场空间做一个大致的研究分析,同时判断IC网络是否具有合作潜力。吴勉认为:“一家具有合作潜力的从事电子商务的互联网公司,需要有庞大的客户群体,而与一家具有合作潜力的公司合作,才能拓展自己的盈利空间。”

根据吴勉的观点,无法得出以下哪个结论?( )

吴勉和陈之讨论了对IC网络的业务拓展,他们认为第一步需要对B2C的市场空间做一个大致的研究分析,同时判断IC网络是否具有合作潜力。吴勉认为:“一家具有合作潜力的从事电子商务的互联网公司,需要有庞大的客户群体,而与一家具有合作潜力的公司合作,才能拓展自己的盈利空间。”

根据吴勉的观点,无法得出以下哪个结论?( )

A.

一家从事电子商务的互联网公司除非拥有庞大的客户群体,否则与其合作不能拓展自己的盈利空间

B.

如果与IC网络合作能够拓展自己的盈利空间,它就不会没有庞大的客户群体

C.

不能设想IC网络具有合作潜力,但其缺乏庞大的客户群体

D.

只要IC网络拥有庞大的客户群体,与其合作就能拓展自己的盈利空间

第 2 题

单选题

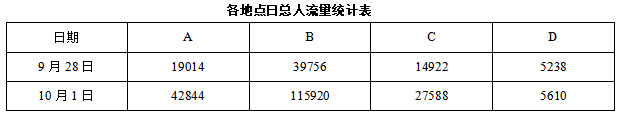

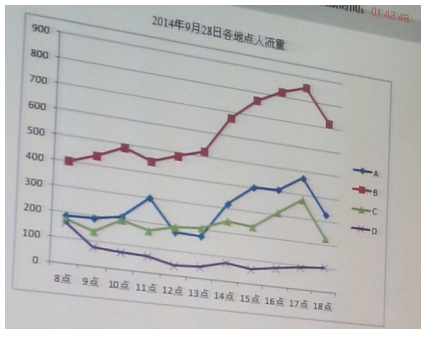

讨论结束后,橙队对B2C的市场空间以及IC网络的客户群体展开了调查。

陈之查阅了中国电子商务研究中心(100EC.CN)2014年的市场监测数据,数据显示,2014年第2季度,中国B2C市场交易规模为3204.7亿元,环比增长23.7%,同比上涨72%。

根据这些数据,陈之大致估算了一下,中国2014年上半年B2C市场的交易规模约为________亿元。(保留一位小数)

陈之查阅了中国电子商务研究中心(100EC.CN)2014年的市场监测数据,数据显示,2014年第2季度,中国B2C市场交易规模为3204.7亿元,环比增长23.7%,同比上涨72%。

根据这些数据,陈之大致估算了一下,中国2014年上半年B2C市场的交易规模约为________亿元。(保留一位小数)

A.

5795.4

B.

5895.4

C.

5795.4

D.

5795.5

第 3 题

单选题

除此之外,橙队还研究了几个其他银行与电商在互联网金融领域合作的案例。通过案例分析,他们对银行与电商合作的模式有了一定了解,以合作销售理财产品为例,由于存在收益分成,产品的利润率会下降,但产品的销量会增加。

假设诺鑫银行与IC网络合作销售理财产品,产品利润率下降20%,但每月销量增加56%,那么该理财产品的每月总利润会增加_____________%。

假设诺鑫银行与IC网络合作销售理财产品,产品利润率下降20%,但每月销量增加56%,那么该理财产品的每月总利润会增加_____________%。

A.

24.8%

B.

14.8%

C.

25.8%

D.

24.4%

第 4 题

单选题

两天后,吴勉和陈之一起就双方的合作对IC网络进行了初步的沟通拜访。

IC网络的负责人向陈之介绍了关于在未来一年里重新架构I易购平台的计划,他表示新架构的I易购将更加专注于时尚品牌的建立,同时对于时尚品牌的理念,该负责人也进行了阐述:

①广告公司和传媒是拜物教的布道者。

②它们负责阐述和传播“意义”,消费者负责接收“意义”,直至最后为这些虚无缥缈的“意义”买单。

③快速消费品行业和时尚行业最热衷于塑造logo,前者需要横向的地毯式轰炸营造品牌幻觉,后者需要纵向的高端价值塑造以榨取高附加值。

④物质丰裕的年代里,拜物教大行其道。

⑤各式logo因而成为最显眼的图腾——你不一定能发出它们的标准读音,但在广告的教育下,你一定明白它来自哪个国家,代表哪一类商品,象征的是古典还是现代。

⑥你未必每周去读经或者做礼拜,但你必定每天在家里、电梯和公交车上接受广告的洗礼。

陈之快速记录下了该负责人阐释的内容,为了使内容的语义更加连贯,又重新调整了这些内容的顺序,调整后的顺序应该是( )。

IC网络的负责人向陈之介绍了关于在未来一年里重新架构I易购平台的计划,他表示新架构的I易购将更加专注于时尚品牌的建立,同时对于时尚品牌的理念,该负责人也进行了阐述:

①广告公司和传媒是拜物教的布道者。

②它们负责阐述和传播“意义”,消费者负责接收“意义”,直至最后为这些虚无缥缈的“意义”买单。

③快速消费品行业和时尚行业最热衷于塑造logo,前者需要横向的地毯式轰炸营造品牌幻觉,后者需要纵向的高端价值塑造以榨取高附加值。

④物质丰裕的年代里,拜物教大行其道。

⑤各式logo因而成为最显眼的图腾——你不一定能发出它们的标准读音,但在广告的教育下,你一定明白它来自哪个国家,代表哪一类商品,象征的是古典还是现代。

⑥你未必每周去读经或者做礼拜,但你必定每天在家里、电梯和公交车上接受广告的洗礼。

陈之快速记录下了该负责人阐释的内容,为了使内容的语义更加连贯,又重新调整了这些内容的顺序,调整后的顺序应该是( )。

A.

③⑤④①②⑥

B.

④⑥①②⑤③

C.

③⑥⑤④①②

D.

④①②⑥③⑤

第 5 题

单选题

在沟通中,陈之了解到目前I易购的新架构设计已经开始,按照原计划,本来设计工作IC网络打算自己做,预估40个工作日完成。6个工作日后,由于进度要求提前,改由IC网络与外包公司合作完成。外包公司独立完成设计工作需要28个工作日。

按照目前的情况,陈之估算了一下,I易购的新架构设计完成一共需要( )个工作日。

按照目前的情况,陈之估算了一下,I易购的新架构设计完成一共需要( )个工作日。

A.

14

B.

26

C.

28

D.

20

第 6 题

单选题

IC网络的负责人在沟通时强调,希望新架构的I易购平台在使用方面具有更好的安全性,IC网络内部关于这个问题也提出了一些建议,诸如以下选项的内容。

吴勉针对这个问题也给出了自己的建议,他认为( )是目前电商网站一般会采用的安全技术手段,建议IC网络采用这项技术。

吴勉针对这个问题也给出了自己的建议,他认为( )是目前电商网站一般会采用的安全技术手段,建议IC网络采用这项技术。

A.

内置防钓鱼软件

B.

使用安全域名

C.

预置功能更好的防木马软件

D.

用数字签名解决篡改或冒充等问题

第 7 题

单选题

陈之对4G技术也有一定的了解,4G是第四代移动通信及其技术的简称,是集3G与( )于一体,能够传输高质量视频图像,以及图像传输质量与高清晰度电视不相上下的技术产品。

A.

GSM

B.

WLAN

C.

2G

D.

WIFI

第 8 题

单选题

拜访结束后,吴勉对于A网络负责人提到的I易购的beta版不是很明白,陈之告诉他,beta版通常是指( )。

A.

正式版

B.

外部测试版

C.

演示版

D.

内部测试版

第 9 题

单选题

对于IC网络的首次拜访结束后,陈之根据沟通的主要情况以及对方的需求写了一份纪要,提交给研发部门,希望听听他们的反馈。

报告中写道:

(1)垂直电商是一个完整的产业链,目前国内垂直电商模式依然处于探索阶段,企业的( )模式也因此受到一定的束缚。

(2)我行需要改变目前在线支付产品单一的局面,希望在未来会有更丰富、更安全的适用于不同平台的支付新产品( )。

填入上文空缺处恰当的词语是( )。

报告中写道:

(1)垂直电商是一个完整的产业链,目前国内垂直电商模式依然处于探索阶段,企业的( )模式也因此受到一定的束缚。

(2)我行需要改变目前在线支付产品单一的局面,希望在未来会有更丰富、更安全的适用于不同平台的支付新产品( )。

填入上文空缺处恰当的词语是( )。

A.

盈利;面世

B.

营利;面世

C.

营利;面市

D.

盈利;面市

第 10 题

单选题

在报告中也谈到了“直销银行”,以下有关“直销银行”的说法,正确的是( )。

A.

直销银行是依托银行实体营业网点发展起来的新型银行运作模式

B.

直销银行是现行的“电话银行”、“网上银行”等电子银行的总称

C.

目前全球最大的直销银行机构是HSBC Direct

D.

直销银行可以提供线上和线下融合、互通的渠道服务

第 11 题

单选题

很快,研发部门给出了初步反馈,新架构的I易购移动客户端需要用到一种基于位置的服务——LBS(Location Based Service)。那么,( )无法为LBS提供获取位置信息方面的技术支持。

A.

WCDMA

B.

GPS

C.

OAO

D.

CDMA

第 12 题

单选题

同时,对于IC网络提出的有关高科技支付方式的需求,研发部门有同时提出意见:认为满足这项需求将需要投入一大笔研发经费,这会大大增加产品的研发成本。

陈之则认为,只有具备足够的资金投入,一个企业的产品才能拥有高科技含量,而这种高科技含量,对于一个产品长期稳定地占领市场是必不可少的。最能削弱其结论的一点是( )。

陈之则认为,只有具备足够的资金投入,一个企业的产品才能拥有高科技含量,而这种高科技含量,对于一个产品长期稳定地占领市场是必不可少的。最能削弱其结论的一点是( )。

A.

晋众电脑拥有高科技含量并长期稳定地占领着市场

B.

洋子洗衣机没能长期稳定地占领市场,但该产品并不缺乏高科技含量

C.

长江电视机没能长期稳定地占领市场,因为该产品缺乏高科技含量

D.

清河空调长期稳定地占领着市场,但该产品的厂家缺乏足够的资金投入

第 13 题

单选题

针对大家对高科技支付手段的反对意见,吴勉认为:随着科技的不断进步,电子支付的安全性与便捷性将成为最重要的问题,高科技在电子支付中的应用成为未来的趋势,当前诺鑫银行应该敢为人先,抢占市场先机。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

“生物识别”所识别的人类生物特征不包括以下哪些特点?( )

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

“生物识别”所识别的人类生物特征不包括以下哪些特点?( )

A.

可测量性

B.

独特性

C.

稳定性

D.

复杂性

第 14 题

单选题

针对大家对高科技支付手段的反对意见,吴勉认为:随着科技的不断进步,电子支付的安全性与便捷性将成为最重要的问题,高科技在电子支付中的应用成为未来的趋势,当前诺鑫银行应该敢为人先,抢占市场先机。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

虹膜面积大约占眼睛外观面积的( )。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

虹膜面积大约占眼睛外观面积的( )。

A.

5%

B.

65%

C.

85%

D.

35%

第 15 题

单选题

针对大家对高科技支付手段的反对意见,吴勉认为:随着科技的不断进步,电子支付的安全性与便捷性将成为最重要的问题,高科技在电子支付中的应用成为未来的趋势,当前诺鑫银行应该敢为人先,抢占市场先机。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

以下属于“掌静脉识别”技术特征的是( )。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

以下属于“掌静脉识别”技术特征的是( )。

A.

活体识别

B.

外部特征

C.

易干扰

D.

接触式

第 16 题

单选题

针对大家对高科技支付手段的反对意见,吴勉认为:随着科技的不断进步,电子支付的安全性与便捷性将成为最重要的问题,高科技在电子支付中的应用成为未来的趋势,当前诺鑫银行应该敢为人先,抢占市场先机。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

有关“掌静脉识别”,以下说法正确的是( )。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

有关“掌静脉识别”,以下说法正确的是( )。

A.

如果手掌皮肤受伤,将无法使用掌静脉识别

B.

市面上有指纹膜售卖,“掌静脉识别”较易伪造

C.

在实际应用中,如果希望缩短掌静脉识别时间,代价较大

D.

使用掌静脉识别,是对指纹和掌纹的识别

第 17 题

单选题

针对大家对高科技支付手段的反对意见,吴勉认为:随着科技的不断进步,电子支付的安全性与便捷性将成为最重要的问题,高科技在电子支付中的应用成为未来的趋势,当前诺鑫银行应该敢为人先,抢占市场先机。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

从文中可以看出,以下说法正确的是( )。

经过沟通,大家对高科技支付手段的研发达成了共识。研发部门积极展开调研,并进行产品原型的设计。

一天,吴勉给了陈之一份资料,是研发部门搜集的国外关于高科技支付手段的研究介绍,重点介绍了生物识别技术,以下是这份材料,根据材料内容,回答所给的5个问题。

材料1:

生物识别技术是指通过计算机与光学、声学、生物传感器和生物统计学原理等高科技手段密切结合,利用人体固有的生理特征,(如指纹、静脉、人脸、虹膜等)和行为特征(如笔迹、声音、步态等)来进行个人身份的鉴定。这些特征通常需要具备唯一性、可测量性、遗传性(终身基本不变)等特点。

现今生物识别技术的类别越来越丰富,如指纹识别、虹膜识别、视网膜识别、静脉识别、面部识别、签名识别、声音识别等。虽然其中一部分技术含量高的生物识别手段还处于实验阶段,但是我们相信,随着科学技术的飞速进步,将有更多的生物识别技术应用到实际生活中。

材料2:

人眼睛的外观结构由巩膜、虹膜、瞳孔三部分构成。巩膜即眼球外围的白色部分,约占总面积的百分之三十。眼睛中心为瞳孔部分,约占百分之五。虹膜位于巩膜和瞳孔之间,包含了最丰富的纹理信息。外观上看,虹膜由许多腺窝、皱褶、色素斑等构成,是人体中最独特的结构之一。人体基因表达决定了虹膜的形态、生理、颜色和总的外观。人发育到八个月左右,虹膜就基本上发育到了足够尺寸,进入了相对稳定的时期。只有极少见的反常状况、身体或精神上大的创伤才可能造成虹膜外观上的改变。除此之外,虹膜形貌可以保持数十年不变。另一方面,虹膜是外部可见的,但同时又属于内部组织,位于角膜后面。因此,如果想改变虹膜外观,需要非常精细的外科手术,而且存在视力损伤的危险。虹膜的高度独特性、稳定性及相对难以更改等特点,是虹膜可用作身份鉴别的物质基础。

相对于指纹识别,虹膜识别除了具备便捷性外,精确度更高。虹膜识别被认为是二十一世纪最具有发展前途的生物识别技术,未来的安防、国防、电子商务等多个应用领域,也必然会以虹膜识别技术为发展重点。

材料3:

静脉是导血回心的血管,起于毛细血管,止于心房,表浅静脉在皮下可以看见。掌静脉,顾名思义,就是手掌内静脉。掌静脉识别是静脉识别的一种,属于生物识别,掌静脉识别系统就是首先通过静脉识别仪取得个人掌静脉分布图,从掌静脉分布图依据专用比对算法提取特征值,通过红外线CCD摄像头获取手指、手掌、手背静脉的图像,将静脉的数字图像存贮在计算机系统中,将特征值存储。静脉比对时,实时采取静脉图,提取特征值,运用先进的滤波、图像二值化、细化手段对数字图像提取特征,同存储在主机中静脉特征值比对,采用复杂的匹配算法对静脉特征进行匹配,从而对个人进行身份鉴定,确认身份。

掌静脉识别有以下几项技术特点:1)用掌静脉进行身份认证时,获取的是掌静脉的图像特征,是掌活体时才存在的特征。在该系统中,非活体的手掌是得不到静脉图像特征的,因而无法识别,从而也就无法造假。2)用掌静脉进行身份认证时,获取的是手掌内部的静脉图像特征,而不是手掌表面的图像特征。因此,不存在任何由于手掌表面的损伤、磨损、干燥或太湿等带来的识别障碍。3)用掌静脉进行身份认证,获取手掌静脉图像时,手掌无须与设备接触,轻轻一放,即可完成识别。4)因为有了前面的3个方面的特征,确保了使用者的掌静脉特征很难被伪造。所以掌静脉识别系统安全等级高,特别适合于安全要求高的场所使用。

韩国首尔大学电子工程系有一篇关于掌静脉识别算法的文献,介绍了传统的静脉识别算法以及如何用昂贵的DSP处理器处理浮点运算和提高实时性要求,缩短识别时间,文献中描述的静脉识别算法主要包括3大部分:静脉图像的获取;静脉图像预处理和静脉识别。图像预处理部分主要由高斯低通滤波、阂值处理、双线性滤波以及改进的中值滤波等组成。通过对5000个样本进行实验,识别率达到94.88%。

从文中可以看出,以下说法正确的是( )。

A.

掌静脉识别比虹膜识别安全等级高

B.

人死后可以识别虹膜,但不能识别掌静脉

C.

目前,虹膜识别的应用前景优于掌静脉识别

D.

外科手术可以改变虹膜,但不能改变掌静脉

第 18 题

单选题

高科技支付方式的研发工作已经进行了两周。原计划下个月初会完成初步的产品原型设计。但是由于IC网络对I易购平台的需求总在调整,导致新产品研发出现了“瓶颈效应”。吴勉为此事正在与IC网络进行频繁的沟通。

吴勉在网上查询了一下“瓶颈效应”的含义:进行某项创造活动时,或从事某一学习、工作和生活的角色行为时,要求与之相关的各因素、环节配合与协调并进,如果其中某一因素和环节跟不上,就会成为“瓶颈”卡住整个活动和某一行为的正常进行。

结合现实情况,吴勉觉得生活中有很多情况都属于“瓶颈效应”,如( )。

吴勉在网上查询了一下“瓶颈效应”的含义:进行某项创造活动时,或从事某一学习、工作和生活的角色行为时,要求与之相关的各因素、环节配合与协调并进,如果其中某一因素和环节跟不上,就会成为“瓶颈”卡住整个活动和某一行为的正常进行。

结合现实情况,吴勉觉得生活中有很多情况都属于“瓶颈效应”,如( )。

A.

在路上遇到一位老同学,明明知道他的名字的,但又突然间想不起来了

B.

在工作中要酝酿一种设想时,惊喜地发现一种构思终于出来了,可兴奋后又发现不合适

C.

自己孤军奋战,效率很低,但是与人交流之后,突然发现其实事情比想象的简单许多

D.

对一个问题百思不得其解,突然有一天茅塞顿开

第 19 题

单选题

吴勉这段时间忙于推进易购平台架构的最终方案,希望陈之能负责联系一下研发部门的李辰,跟进研发部门的进展。但是在这之前陈之与李辰的几次沟通都不愉快。陈之觉得李辰太固执,而李辰认为陈之是新员工,缺少经验,不愿意听取陈之的意见。对于即将开始的工作,陈之应该怎么办?

A.

先与李辰就任务执行方案进行沟通,并在工作中找时机提醒他变通下工作风格

B.

向吴勉委婉建议更换研发部门的对接人

C.

主动与李辰沟通,如一起吃饭、聊天等,建立起信任后再开展工作

D.

一切以完成任务为主,与李辰有分歧时据理力争

第 20 题

单选题

像李辰与陈之之间的沟通障碍在沟通障碍在日常沟通中经常存在,以下沟通障碍中,属于主观沟通障碍的是:

A.

信息沟通渠道和沟通方式选择不当引起的沟通障碍

B.

组织结构不合理引起的沟通障碍

C.

沟通环境的影响引起的沟通障碍

D.

知识、经验水平、文化背景的差距引起的沟通障碍

第 21 题

单选题

5月份,诺鑫银行启动第五届全国大学生金融产品创新设计大赛,为提升本次大赛各高校的参与度,紫队成员负责此次赛事的宣传活动。活动由张黎负责,老员工孙凯提供指导。

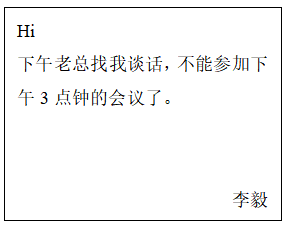

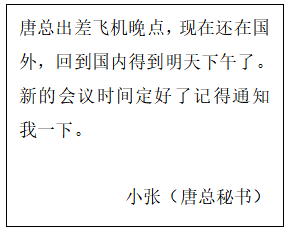

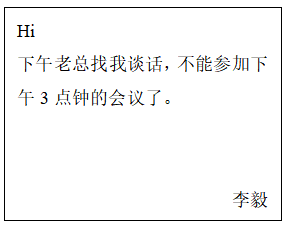

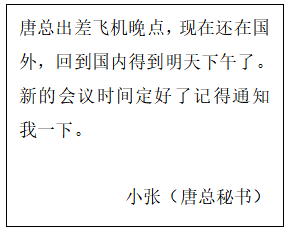

首先需要开一个宣传活动方案策划会议,王总让张黎帮忙安排。根据大家的时间,张黎定在了周二下午3点,会议为两个小时,王总、唐总、李毅、孙凯和张黎都将参加。但是周二上午刚到办公室,张黎就看见桌上有以下四张便签。

由于时间较为紧急,所以需要马上重新预订会议室,本周的会议室均有空余,新的会议时间应该安排在什么时间?请选择( )。

首先需要开一个宣传活动方案策划会议,王总让张黎帮忙安排。根据大家的时间,张黎定在了周二下午3点,会议为两个小时,王总、唐总、李毅、孙凯和张黎都将参加。但是周二上午刚到办公室,张黎就看见桌上有以下四张便签。

由于时间较为紧急,所以需要马上重新预订会议室,本周的会议室均有空余,新的会议时间应该安排在什么时间?请选择( )。

A.

周四上午11点

B.

周三下午2点

C.

周四下午2点

D.

周五上午11点

E.

周三上午11点

第 22 题

单选题

新的会议如期召开了,在会上,首先对往届的大赛情况进行了回顾。

总行编辑了一版往届竞赛回顾集,共800页。那么在1—800这些页码数字中,除去平方数和立方数还有( )个数。

总行编辑了一版往届竞赛回顾集,共800页。那么在1—800这些页码数字中,除去平方数和立方数还有( )个数。

A.

763

B.

766

C.

772

D.

791

第 23 题

单选题

在回顾集中,还有以下一些表述:

(1)这些作品贴近大学生的实际需求,紧跟网络时尚潮流,展现了参赛选手个性鲜明、思维活跃的特点。

(2)反映了当代大学生密切关注国民经济发展、社会民生等热点问题,力求用所学知识服务社会、服务人民群众的责任感和使命感。

(3)大学生金融创新大赛是诺鑫银行的一项传统赛事,不仅能够征集创意,更是拓展年轻客户市场的创新手段。

(4)今年这届大赛,参赛学生数实现倍增,力争在全国吸引更多大学生参与本届大赛,进一步扩大大赛覆盖面。

你仔细读了一下,觉得其中一句的表述不太准确的是( )。

(1)这些作品贴近大学生的实际需求,紧跟网络时尚潮流,展现了参赛选手个性鲜明、思维活跃的特点。

(2)反映了当代大学生密切关注国民经济发展、社会民生等热点问题,力求用所学知识服务社会、服务人民群众的责任感和使命感。

(3)大学生金融创新大赛是诺鑫银行的一项传统赛事,不仅能够征集创意,更是拓展年轻客户市场的创新手段。

(4)今年这届大赛,参赛学生数实现倍增,力争在全国吸引更多大学生参与本届大赛,进一步扩大大赛覆盖面。

你仔细读了一下,觉得其中一句的表述不太准确的是( )。

A.

(1)

B.

(3)

C.

(4)

D.

(2)

第 24 题

单选题

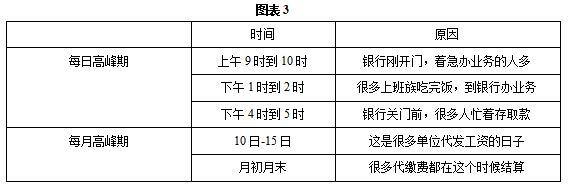

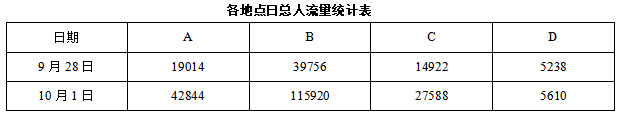

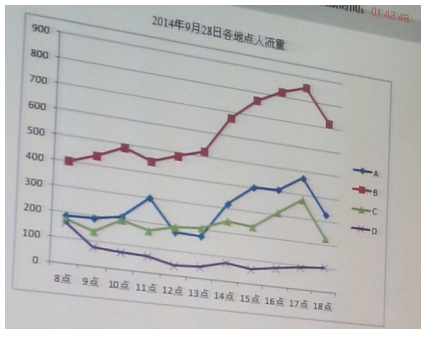

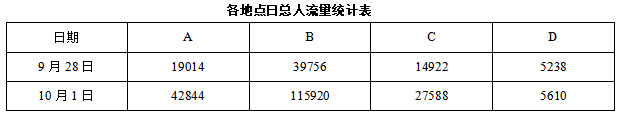

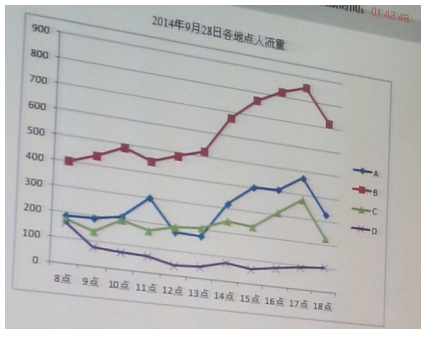

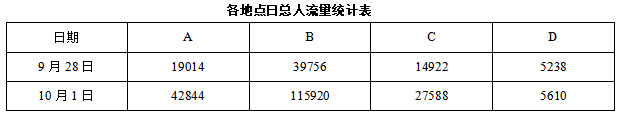

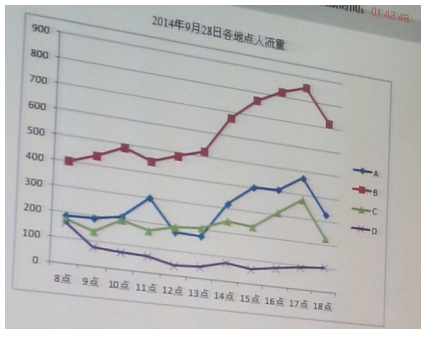

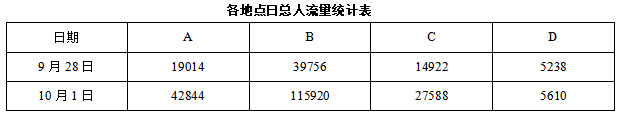

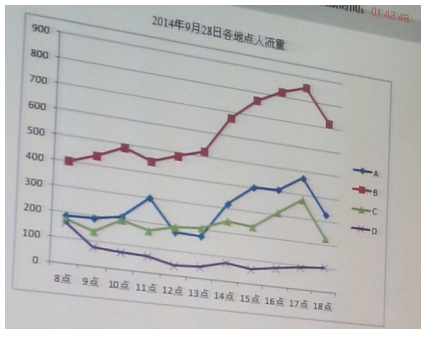

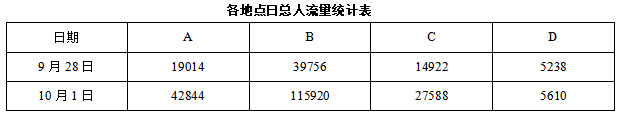

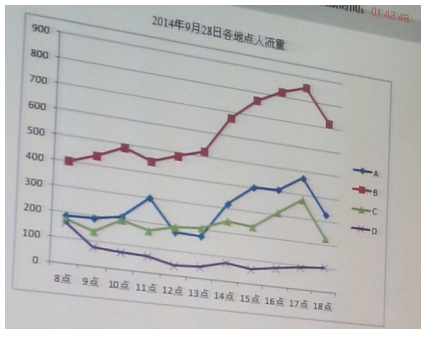

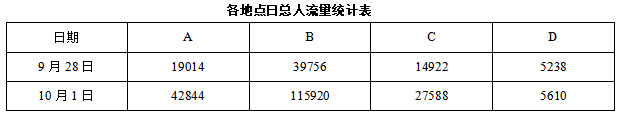

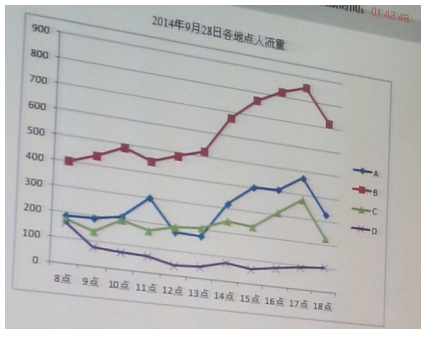

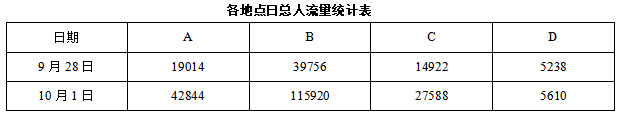

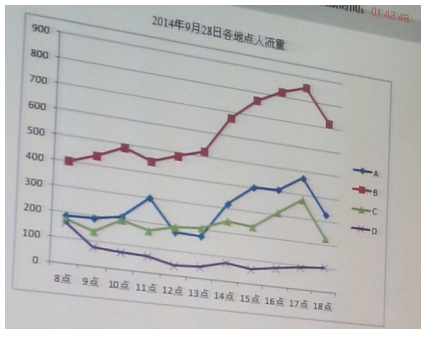

大赛历经4载,参赛高校已覆盖了国内一半左右的本科以上高校,参赛的重点院校已由第二届的40所扩大至第四届的118所。从第四届开始,大赛增加了贵金属模拟交易比赛内容。在赛事开展期间,诺鑫银行积极组织参赛学生开展银行网点体验、诺鑫银行服务体验、业务流程体验等活动,引导参赛选手结合体验活动提出创意方案。这些活动,向大学生们普及了理财基本知识,同时激发了大学生参与投资理财的热情和积极性,不少大学生在银行开立了基金、贵金属、三方存管等交易账户,增强了大学生客户对诺鑫银行的忠诚度。另外,诺鑫银行还为获奖选手提供实习机会,如让大学生担任网点的大堂经理,协助银行后台工作人员处理业务文档等,既为大学生提供了增加职场实践经验的机会,也加深了大学生对银行工作的认识和理解。下图为前四届大赛相关数据:

根据以上资料,下述分析错误的是( )。

根据以上资料,下述分析错误的是( )。

A.

第四届的参赛人数相当于前三届参赛人数的总和

B.

全国本科以上高校至少有1000所

C.

第四届大赛增加了贵金属模拟交易比赛,使得参赛人数大幅提升

D.

本赛事对重点院校学生的吸引力逐年加大

第 25 题

单选题

大赛历经4载,参赛高校已覆盖了国内一半左右的本科以上高校,参赛的重点院校已由第二届的40所扩大至第四届的118所。从第四届开始,大赛增加了贵金属模拟交易比赛内容。在赛事开展期间,诺鑫银行积极组织参赛学生开展银行网点体验、诺鑫银行服务体验、业务流程体验等活动,引导参赛选手结合体验活动提出创意方案。这些活动,向大学生们普及了理财基本知识,同时激发了大学生参与投资理财的热情和积极性,不少大学生在银行开立了基金、贵金属、三方存管等交易账户,增强了大学生客户对诺鑫银行的忠诚度。另外,诺鑫银行还为获奖选手提供实习机会,如让大学生担任网点的大堂经理,协助银行后台工作人员处理业务文档等,既为大学生提供了增加职场实践经验的机会,也加深了大学生对银行工作的认识和理解。下图为前四届大赛相关数据:

根据以上资料,以下描述正确的是( )。

根据以上资料,以下描述正确的是( )。

A.

每名参赛学生都能够参加银行业务体验活动

B.

学生通过参加赛事能够了解到理财基本知识

C.

每名参赛学生都能获得诺鑫银行的实习机会

D.

只有参加了银行体验活动的学生才能提出创意方案

第 26 题

单选题

赛事活动的第一阶段完成,张黎作为项目负责人,需要召开一次由部门领导及其部门同事参加的项目进展汇报会议。在会议进行过程中,张黎听到了许多与他观点不同的意见,而且他也知道这些意见有关偏颇是因为发言者掌握的项目资料不全。此时,张黎最佳的做法是:

A.

先让大家畅所欲言,最后再对方案中存在的问题作解答

B.

及时打断方向明显走偏的发言,以免误导整体讨论进度和方向

C.

让同事帮忙打印出项目细节的有关材料分发给与会人员,以帮助大家了解具体情况

D.

停下来先对项目的整体情况做详细介绍,稍后再继续讨论

第 27 题

单选题

在会议上,张黎根据以往的经验提出了自己的建议,得到了领导的肯定和认同,但最终领导并没有采纳他的建议,反而采取了和他建议相悖的做法,而张黎觉得自己的做法更具有建设性,你觉得张黎这时会怎么办?

A.

心里不服气,但只能接受上级领导的决定

B.

放弃自己的建议,接受上级领导的决定,配合方案的实施

C.

反思自己提出的方案存在的问题,从领导角度考虑方案的可行性

D.

与领导直接沟通,征询上级领导对自己方案的想法

第 28 题

单选题

会议决定向一家商店订购600个无线鼠标作为宣传活动赠品,鼠标每个定价100元,张黎向商店经理说:“如果你有减价,每减1元,我就多订购20个。”商店经理算了一下,如果减价10%,由于会多订购,仍可获得与原来一样多的利润,则这种无线鼠标每个的成本是( )元。

A.

50

B.

75

C.

80

D.

60

第 29 题

单选题

紫队初步选择了赴四个城市的高校进行宣传,分别在甲、乙、丙、丁四个地方,甲地和丙地出行当天的天气相同,乙地和丁地出行当天没有雨,四个地方共有三种天气情况。下面哪个推断是不准确的?( )

A.

甲地

B.

丙地

C.

丁地

D.

乙地

第 30 题

单选题

宣传小组成员中恰好有四位,一个比一个大一岁,他们的年龄相乘等于255024,问其中最大的年龄是多少岁?

A.

25

B.

24

C.

26

D.

23

第 31 题

单选题

在宣传活动现场,张黎听到有几个学生在一起讨论本班同学大赛报名情况。

甲说:“我班所有同学都已报名了”

乙说:“如果班长报名了,那么学习委员就没报名”

丙说:“班长报名了”

丁说:“我班有人没有报名”

已知四人中只有一人说假话,则可推出以下哪项结论?( )

甲说:“我班所有同学都已报名了”

乙说:“如果班长报名了,那么学习委员就没报名”

丙说:“班长报名了”

丁说:“我班有人没有报名”

已知四人中只有一人说假话,则可推出以下哪项结论?( )

A.

甲说假话,班长没有报名

B.

丙说假话,班长没有报名

C.

甲说假话,学习委员没有报名

D.

乙说假话,学习委员没有报名

第 32 题

单选题

在宣传活动开始前,对39名使用过电子银行(网上银行、手机银行、微信银行、电话银行)的学生进行了调查。发现其中有28人最常使用的不是网上银行,24人最常使用的不是手机银行,最常使用网上银行和手机银行两种电子银行的人数是20人,最常使用微信银行的人比最常使用电话银行的多4人,那么最常使用电话银行的人共有( )个。

A.

3

B.

5

C.

6

D.

4

第 33 题

单选题

宣传活动结束时,参与的学生之间相互赠送卡片留念。现有一张长954毫米、宽318毫米的长方形纸,剪成多个面积相等且尽可能大的正方形卡片,长方形纸最后没有剩余,则这些正方形的边长是( )毫米。

A.

19

B.

79

C.

106

D.

53

第 34 题

单选题

贵金属模拟交易比赛第一赛程结束后,张黎了解了一下安徽赛区综合排名靠前的四名选手的交易收益情况,发现A的收益是另外3人收益总额的 ,B的收益是另外3人收益总额的

,B的收益是另外3人收益总额的 ,C的收益是另外3人收益总额的

,C的收益是另外3人收益总额的 ,D的收益是2600元,A的收益是( )元。

,D的收益是2600元,A的收益是( )元。

,B的收益是另外3人收益总额的

,B的收益是另外3人收益总额的 ,C的收益是另外3人收益总额的

,C的收益是另外3人收益总额的 ,D的收益是2600元,A的收益是( )元。

,D的收益是2600元,A的收益是( )元。

A.

4000

B.

4600

C.

4800

D.

4200

第 35 题

单选题

在安徽分赛区决赛阶段,共有800名评审团成员对2名选手提出的方案进行表决裁定。评审团的成员只能投赞成票或否决票,不能弃权。现在知道赞成选手A的有425人,赞成选手B的有394人,对A和B两个方案都否决的有268人。那么,请问赞成选手B同时否决选手A的有( )人。

A.

68

B.

107

C.

138

D.

224

第 36 题

单选题

由于工作努力尽职,领导决定对张黎进行奖励,让张黎在以下两项奖励中选择一样:一是改善他的工作条件;二是分配一项具有挑战性的新任务给他。张黎选择了第二项,且工作更加尽力。领导的这种做法符合________的观点。

A.

强化理论

B.

期望理论

C.

双因素理论

D.

公平理论

第 37 题

单选题

为了完成工作任务,张黎常常会加班;而与此同时,也有一些客户会在业余时间让张黎帮忙办一些与工作无关的事。此时,张黎不可避免地会产生一些个人情绪。面对这种情况,张黎应该:

A.

把自己得情绪隐藏好,因为维护好客户是本职工作,即便是有个人情绪,也不会轻易显露出来,心平气和的跟客户交流

B.

控制自己的个人情绪,然后选用委婉的方式拒绝客户,有理有据的说服客户,希望客户能够理解我的工作难处

C.

热心的帮客户解决自己能力范围内的事情,客户的打扰是种变相的信任,更能够拉近距离

D.

对于客户的这种行为表示理解,工作时间跟客户的时间不一致是常有的事情,尽自己最大的能力服务客户 这次赛程宣传和组织活动非常成功,同事们对紫队的表现给予了较高的评价。

第 38 题

单选题

2014年4月初,富洲石化有限公司决定联合富洲市其他能源企业,成立富洲天然气管网有限公司(以下简称“富洲天然气管网”)。为了支持公司未来发展战略,富洲天然气管网定于4月30日举办贷款项目招标,并在4月20日向多家实力雄厚的银行发出了邀标书,诺鑫银行富洲分行也在受邀之列。总行收到富洲分行的项目评审申请后,召开了紧急会议。会议讨论决定由总行授信审批部组织骨干成员前往富洲分行,与分行同事一起在项目一线开展工作。在富洲分行学习的青队学员曹轩,负责完成此项任务。

陈辉是总行授信审批部的一名资深经理,主要负责在授信审批环节对一些重点项目进行效益评审,经过前期沟通,其定于2014年4月23日从北京出发前往富洲。陈辉请曹轩协助安排行程和订购火车票。

经查询,北京直达富洲的高铁票已售罄,只有直达慢车尚有余票。另外,也可以选择从北京乘坐高铁到甲地,再从甲地乘坐高铁到富洲。北京距富洲2189千米;北京距甲地1250千米,甲地距富洲1518千米。直达慢车时速为123千米/小时,高铁时速为251千米/小时,但是高铁列车比直达慢车晚出发1.5小时,同时,在甲地转车需要2.5小时。请问从北京到富洲,乘坐直达慢车比高铁转车( )。

陈辉是总行授信审批部的一名资深经理,主要负责在授信审批环节对一些重点项目进行效益评审,经过前期沟通,其定于2014年4月23日从北京出发前往富洲。陈辉请曹轩协助安排行程和订购火车票。

经查询,北京直达富洲的高铁票已售罄,只有直达慢车尚有余票。另外,也可以选择从北京乘坐高铁到甲地,再从甲地乘坐高铁到富洲。北京距富洲2189千米;北京距甲地1250千米,甲地距富洲1518千米。直达慢车时速为123千米/小时,高铁时速为251千米/小时,但是高铁列车比直达慢车晚出发1.5小时,同时,在甲地转车需要2.5小时。请问从北京到富洲,乘坐直达慢车比高铁转车( )。

A.

早1.7小时

B.

早2.7小时

C.

晚2.7小时

D.

晚1.7小时

第 39 题

单选题

根据“四象限管理法则”,曹轩所负责的“富洲天然气管网”项目属于第________象限。

A.

一

B.

三

C.

四

D.

二

第 40 题

单选题

项目组由10名成员组成,其中有4名女士,有8个人毕业于金融系,有7个人来自富洲市。那么以下说法正确的是( )。

A.

有5名男士来自富洲市但是没有毕业于金融系

B.

4名女士中最多有2名女士来自富洲市

C.

5名金融系毕业的男士中只有一个富洲人

D.

4名女士中至少有2名女士毕业于金融系

第 41 题

单选题

项目组成员年龄分别为:2人26岁、1人27岁、2人28岁、3人30岁、2人35岁。那么项目组成员年龄的中数是( )岁。

A.

27

B.

29

C.

30

D.

28

第 42 题

单选题

项目会议结束后,有四个项目组成员要去四个地方落实工作。已知到A处星期一没有直达车,到B处星期三没有直达车,到C处星期四没有直达车,到D处只有星期二、四、六有直达车,星期日到A、B、C、D四处均没有直达车。当问到甲、乙、丙、丁四人何时去办事时,甲说:“我今天必须去,明天就没有直达车了。”乙说:“我和甲正相反,今天没有直达车,明天有。”丙说:“我从今天起,连着四天都有直达车。”丁说:“你们可别像我前天那样,在没有直达车的日子去。”据此可以推断这一天是( )。

A.

星期一

B.

星期三

C.

星期四

D.

星期二

第 43 题

单选题

陈辉建议,项目组采用头脑风暴法,看看能否在工作思路上有所突破,解决时间紧,任务重的难题。头脑风暴是现代创造学奠基人亚历克斯·奥斯本于1938年首次提出的。这种方法通过有关专家之间的信息交流,引起思维共振,产生组合效应,从而导致创造性思维。头脑风暴法应遵循的原则是:

A.

与会者在会上应对他人的设想进行评判

B.

与会者仅限于自己的专业领域提出设想

C.

每个与会者只能提出一个设想

D.

与会者尽可能多而广地提出设想

第 44 题

单选题

本次项目涉及总行和分行协同工作,但因为项目紧急,前期对项目费用的归属和报销问题并没有明确说明。头脑风暴开始后,有一位负责项目相关费用的同事,一直不停的提问。陈辉最佳做法是:

A.

先解答他的问题,然后再开始会议

B.

告诉该同事在会议结束之后再提其他问题

C.

告诉大家在会议结束后会对其他问题统一解答

D.

打断他的问题,开始正式会议

第 45 题

单选题

项目加班结束后,曹轩想去买点东西当做夜宵。附近的一家蛋糕店里只剩下6个商品,其中5个是蛋糕,1个是冰激凌。这些商品的价格是30元、32元、36元、38元、40元、62元。前一位顾客买走了两个蛋糕,曹轩买下了剩下的蛋糕,其花费的金额为前一位顾客的2倍。请问冰激凌的价钱是( )元。

A.

36

B.

40

C.

62

D.

38

第 46 题

单选题

确定了工作思路后,项目组成员们依据工作计划,全面展开评审工作。不仅深入企业了解第一手资料,也广泛调研该项目相关的最新信息。

王鑫是富洲分行对公业务部的客户经理,由于工作业绩好、为人和善、乐于助人,得到了同事们的一致认可。之前王鑫也接触过富洲石化,因此,项目组来找王鑫帮忙,请他一起会见客户,调研企业情况。但是,王鑫明天还有一个重要的报告需要向上级提交。王鑫的最佳做法是:

王鑫是富洲分行对公业务部的客户经理,由于工作业绩好、为人和善、乐于助人,得到了同事们的一致认可。之前王鑫也接触过富洲石化,因此,项目组来找王鑫帮忙,请他一起会见客户,调研企业情况。但是,王鑫明天还有一个重要的报告需要向上级提交。王鑫的最佳做法是:

A.

王鑫需要先向上级请示,征求上级意见再做答复

B.

答应陪同项目组一起去见客户,报告自己加班完成

C.

向项目组说明不能去的理由,委婉拒绝

D.

建议项目组找其他客户经理一同前往

第 47 题

单选题

为了响应国家有关“加快发展混合所有制经济”的政策要求,作为国有企业,富洲石化积极申请参与混合所有制改革试点。以下关于混合所有制改革的说法,不正确的是:

A.

混合所有制改革源于寻找国有制同市场经济相结合的形式和途径

B.

混合所有制是指国有资本、集体资本、非公有资本等交叉持股、相互融合的混合所有制经济

C.

混合所有制改革过程中,国有企业会引入大量民营、社会资本

D.

现阶段的混合所有制改革不允许外资参与

第 48 题

单选题

在其实行改革过程中,发生了一些央企与地方国企之间并购情况。陈辉对这些并购做了如下评论:从以往的并购重组经验来看,国企与国企之间的并购重组,效果并不比民营与国企、外资与国企重组的效果好。央企与地方国企之间,出资人代表虽然不一样,但机制和体制却相差不多,________________,并不利于重组后的创新。

根据文意,下列哪句话填入画线处最合适?( )

根据文意,下列哪句话填入画线处最合适?( )

A.

在经营理念和价值取向上是趋同化的

B.

央企大规模并购地方企业的做法不值得提倡

C.

新企业并没有改变所有制属性

D.

央企在经营困难时更容易得到政府的支持

第 49 题

单选题

如果将来富洲天然气管网出现亏损破产,那么根据法律规定,在清算过程中,以下各类债务应优先支付的是:

A.

支付职工工资和劳动保险费用

B.

缴纳所欠税款

C.

按股东持股比例分配剩余资产

D.

支付清算费用

第 50 题

单选题

经调查,发现富洲石化之前在诺鑫银行有一笔不良贷款。富洲石化目前有偿还贷款本息的能力,但是,因为项目问题出现了一些对偿还不利的影响因素。那么这笔贷款应该是以下哪类贷款?( )

A.

关注类

B.

损失类

C.

正常类

D.

次级类

第 51 题

单选题

如果富洲天然气管网项目一旦出现不良资产,将采用信贷重组的方式应对,而非清收贷款。下列不属于信贷重组常用方法的是( )。

A.

展期

B.

债转股

C.

追加或调换担保方式

D.

资产证券化

第 52 题

单选题

2014年3月乌克兰爆发________,俄罗斯向西欧的天然气供应可能会受到影响,该事件将会影响国际天然气供应。

A.

克里米亚事件

B.

桢涅斯克事件

C.

车臣事件

D.

伊格瓦伊斯克事件

第 53 题

单选题

天然气是一种准公共产品,具有有限的非竞争性和非排他性。一般来说,“非竞争性”具体体现在( )。

A.

商品生产成本的增加不会因为消费者或消费数量的增加而增加

B.

消费者在得到一种商品的消费权之后会影响其他消费者的消费

C.

消费者在得到一种商品的消费权之后不会影响其他消费者的消费

D.

消费者或消费数量的增加引起商品生产成本的增加

第 54 题

单选题

经调研,富洲石化有限公司本年与上年相比,偿债能力有所提高。下列财务指标可衡量企业偿债能力的是( )。

A.

资金周转率

B.

资本金利润率

C.

固定资产折旧率

D.

速动比率

第 55 题

单选题

对于此项目,总行开通了绿色通道,对这次项目实施特批,提高了工作效率,减少了许多(繁琐)的审批手续。

可替换括号中词语的是( )。

可替换括号中词语的是( )。

A.

复杂

B.

繁杂

C.

琐碎

D.

繁多

第 56 题

单选题

以下是报告中的一些语句,有语病的一句是( )。

A.

除了加大对重点领域的贷款投放,去年国开行还向十大产业振兴规划项目发放贷款2709亿元,向能源产业发放贷款81.8亿元。

B.

我国石化事业能否迅猛发展,成为我国综合国力的重要标志,关键在于是否拥有持续不断的创新能力。

C.

根据富洲天然气管网有限公司的战略发展规划,需要引进大批优秀人才,包括总经理、业务经理、业务员等大量基层和高层岗位。

D.

我国石油石化生产总体稳定,主要产品产量保持增长,库存增加,供应充分,满足了国内日益增长的消费需求。

第 57 题

单选题

又过了两天,总行反馈项目评审报名审核通过了。接下来项目组需要准备招标的材料。

招标会将于8点30分在富洲大厦12层会议室准时开始。项目组到了富洲大厦后,发现电梯正在维修。曹轩提议大家走楼梯,大家从1层走到4层用了3分钟。以同样的速度继续走楼梯,大家到达12层还需要( )分钟。

招标会将于8点30分在富洲大厦12层会议室准时开始。项目组到了富洲大厦后,发现电梯正在维修。曹轩提议大家走楼梯,大家从1层走到4层用了3分钟。以同样的速度继续走楼梯,大家到达12层还需要( )分钟。

A.

4.5

B.

7

C.

8

D.

6

第 58 题

单选题

在招标会上,陈辉正在陈述诺鑫银行的投资方案,曹轩发现他将一个重要的数字说错了,如不纠正会影响对投标方案的理解。这是曹轩的最佳做法应该是:

A.

先不提出,等陈辉发言结束再向他提示

B.

在陈述结束后向大家澄清错误,消除误解

C.

当时即纠正错误,避免出现误解

D.

立即写在纸上,向陈辉提示其错误

第 59 题

单选题

由于本次贷款项目金额较大,富洲天然气管网决定由两家中标共同完成项目。根据各银行提交的方案,目前暂定代号为A、B、C、D的四家银行入围。

(1)A银行提供的优惠B银行都能提供

(2)C银行提供的优惠包含了B银行提供的所有优惠

(3)C银行提供的部分优惠D银行也能提供

下列说法不正确的是( )。

(1)A银行提供的优惠B银行都能提供

(2)C银行提供的优惠包含了B银行提供的所有优惠

(3)C银行提供的部分优惠D银行也能提供

下列说法不正确的是( )。

A.

C银行提供的某些优惠B银行也能提供

B.

B银行提供的优惠D银行不一定能提供

C.

A银行提供的所有优惠C银行都能提供

D.

D银行提供的所有优惠A银行都能提供 由于总行和分行同事配合默契,总行在此项目上又开通了绿色通道,富洲天然气管网项目顺利中标,青队功不可没。

第 60 题

单选题

为了拓展客户,提升业绩,诺鑫银行不断深化联动营销的业务拓展方式。最近,北京分行准备在辖区内开办一次沙龙,进行高端客户营销,希望以开办代发工资业务为契机,开展其他相关服务,如推广诺鑫银行电商平台、高端个人业务等。此次任务主要由黄队学员卢城来负责。

【开办沙龙】

(A)联动营销是诺鑫银行近年来一直在推的一种营销方式,(B)意即不仅向个人客户营销贷款或者其他金融服务,(C)同时企业客户也能办理需要的其他服务,(D)比如结算业务、电子银行业务等高端业务。

有语病的一项是( )。

【开办沙龙】

(A)联动营销是诺鑫银行近年来一直在推的一种营销方式,(B)意即不仅向个人客户营销贷款或者其他金融服务,(C)同时企业客户也能办理需要的其他服务,(D)比如结算业务、电子银行业务等高端业务。

有语病的一项是( )。

A.

A

B.

B

C.

C

D.

D

第 61 题

单选题

本次沙龙,卢诚计划邀请辖区一些企业的相关负责人参加,他拿到一张企业名单,其中共有600多家企业,这些都是辖区内的中小型企业。这些企业中,有 已经在诺鑫银行开办了代发工资业务,

已经在诺鑫银行开办了代发工资业务, 已经在他行开办了代发工资业务,还有

已经在他行开办了代发工资业务,还有 的企业没有具体的联系方式,卢诚需要给那些有联系方式的、并且没有开办代发工资业务的企业发送沙龙邀请函,本次沙龙共邀请( )企业。

的企业没有具体的联系方式,卢诚需要给那些有联系方式的、并且没有开办代发工资业务的企业发送沙龙邀请函,本次沙龙共邀请( )企业。

已经在诺鑫银行开办了代发工资业务,

已经在诺鑫银行开办了代发工资业务, 已经在他行开办了代发工资业务,还有

已经在他行开办了代发工资业务,还有 的企业没有具体的联系方式,卢诚需要给那些有联系方式的、并且没有开办代发工资业务的企业发送沙龙邀请函,本次沙龙共邀请( )企业。

的企业没有具体的联系方式,卢诚需要给那些有联系方式的、并且没有开办代发工资业务的企业发送沙龙邀请函,本次沙龙共邀请( )企业。

A.

105

B.

75

C.

条件不足,无法计算

D.

21

第 62 题

单选题

题干不全,我们正在全力收集,将在收集成功后第一时间更新。)按照计划,卢诚需要在沙龙上进行业务介绍,以下是其中的一张PPT,其中表述有问题的一处是( )。

A.

A

B.

B

C.

C

D.

D

第 63 题

单选题

诺鑫银行网上商城是本次沙龙推介的另一个重点。电子商务市场前景光明,诺鑫银行适时推出网上商城,将有助于扩展银行业务的范围。

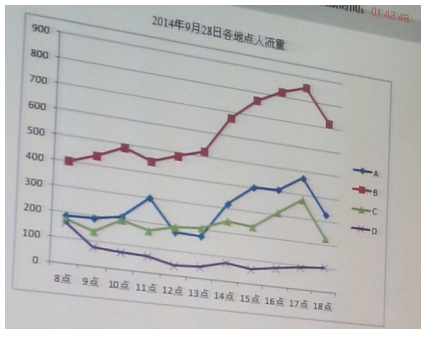

沙龙之后,诺鑫银行的网上商城推出了针对其客户企业的促销活动,活动上线前12天的销售额分别是(万元):1217.7、1217.8、1218.1、1218.4、1218.0、1217.7、1217.9、1218.6、1218.2、1217.5、1218.8、1218.5,那么这12天的日均销售额是( )万元。

沙龙之后,诺鑫银行的网上商城推出了针对其客户企业的促销活动,活动上线前12天的销售额分别是(万元):1217.7、1217.8、1218.1、1218.4、1218.0、1217.7、1217.9、1218.6、1218.2、1217.5、1218.8、1218.5,那么这12天的日均销售额是( )万元。

A.

1217.9

B.

1218.1

C.

1218.2

D.

1218.0

第 64 题

单选题

近几年来,越来越多的企业巨头加入电子商务的竞争行列。2014年8月29日,万达联手________在深圳举行战略合作签约仪式,宣布共同出资成立电子商务公司(简称万达电商),万达电商将成为全球最大的O2O电商平台,真正实现O2O落地,为行业探索O2O发展的模式。

A.

腾讯和阿里巴巴

B.

腾讯和百度

C.

百度和阿里巴巴

D.

万科和腾讯

第 65 题

单选题

除此之外,在互联网金融大潮的推动下,诺鑫银行还计划在网上商城中开辟理财频道,实现理财产品的多渠道营销。上述做法属于以下哪种互联网金融模式?( )

A.

众筹模式

B.

互联网金融门户

C.

大数据金融

D.

第三方支付

第 66 题

单选题

【达成代发工资业务】

沙龙举办的效果非常好,很快就与宏宸宇达公司达成了代发工资业务,并且签订了一份长期合作协议,协议中包括诺鑫银行电商平台业务的推广、红宸宇达子公司业务的合作等。

红宸宇达的发展势头很好,去年的税前利润比前年增加了25%,上缴国家利税1200万元后,还余 ,那么前年的税前利润为( )万元。

,那么前年的税前利润为( )万元。

沙龙举办的效果非常好,很快就与宏宸宇达公司达成了代发工资业务,并且签订了一份长期合作协议,协议中包括诺鑫银行电商平台业务的推广、红宸宇达子公司业务的合作等。

红宸宇达的发展势头很好,去年的税前利润比前年增加了25%,上缴国家利税1200万元后,还余

,那么前年的税前利润为( )万元。

,那么前年的税前利润为( )万元。

A.

2880

B.

3600

C.

4800

D.

3840

第 67 题

单选题

红宸宇达成立于2004年的9月1日,其十周年的庆祝大会于2014年9月1日星期一举行,规模十分宏大。那么十年前公司成立的那天,即2004年的9月1日是( )。

A.

星期天

B.

星期三

C.

星期五

D.

星期一

第 68 题

单选题

9月初,红宸宇达在诺鑫银行电商平台采购奖品,作为福利发放给员工。9月1日,红宸宇达向诺鑫银行发出采购要约。诺鑫银行于9月2日寄出承诺新建,9月8日信件寄达红宸宇达,恰逢相关负责人外出没有收到,9月10日该负责人获悉了该信内容,于9月12日电传告知诺鑫银行已收到承诺。该承诺生效日期为:

A.

2014年9月2日

B.

2014年9月10日

C.

2014年9月12日

D.

2014年9月8日

第 69 题

单选题

红宸宇达公司十周年庆祝大会如期举行,与会人员座位抽签决定。卢诚到达时,桌上有3张扑克牌,背面朝上,无法知晓各张是什么牌。已知:

(1)黑桃在“Q”的右边

(2)梅花与黑桃不相邻

(3)“J”在“K”的左边

(4)方片不在“Q”的右边

那么,从左到右,请你将其备选项拖拽至三张扑克牌的位置。

答题时请用鼠标左键选中匹配项,拖至目标区域内,松开左键后,完成拖拽。单击目标区域里的匹配项可移除该项。

从左到右,三个位置的扑克牌依次为( )

(1)黑桃在“Q”的右边

(2)梅花与黑桃不相邻

(3)“J”在“K”的左边

(4)方片不在“Q”的右边

那么,从左到右,请你将其备选项拖拽至三张扑克牌的位置。

答题时请用鼠标左键选中匹配项,拖至目标区域内,松开左键后,完成拖拽。单击目标区域里的匹配项可移除该项。

从左到右,三个位置的扑克牌依次为( )

A.

梅花J、方片Q、黑桃K

B.

梅花J、黑桃Q、方片K

C.

梅花J、方片K、黑桃Q

D.

黑桃K、方片Q、梅花J

第 70 题

单选题

每月8号时宏辰宇达发放工资日,9月8日时已计提工资600000元,企业应代扣代缴个人所得税为80000元,为职工垫付的房租20000元。对于宏辰宇达来说,以下正确的会计分录是( )。

A.

借:应付工资 600000元 贷:银行存款 600000元

B.

借:应付工资 600000元 贷:应交税金—个人所得税 80000元 其他应收款 20000元 银行存款 500000元

C.

借:应付工资 600000元 其他应收款 20000元 贷:应交税金—个人所得税 80000元 银行存款 500000元

D.

借:应付工资 600000元 贷:应交税金—个人所得税 80000 银行存款 500000元

第 71 题

单选题

在沟通过程中,卢诚首先就银行当前的业务背景做了概述,具体内容如下:

当前,由于客户的金融需求日益多元化、复杂化,银行原有单一的产品已经难以满足客户全方位的需求。因此,近年来我行开始采用全产品营销方法,对庞大复杂的产品体系中的每一项产品都给予足够的关注,根据客户的需求制定产品组合营销计划,深入贯彻落实客户发展战略以及多元化领先者战略,坚持“以客户为中心、以产品组合为核心”的原则,采用“套餐+菜单”的模式,大力开展全产品营销,实现银行从“资金供应商”到“金融服务商”的转变。

这段文字意在说明:

当前,由于客户的金融需求日益多元化、复杂化,银行原有单一的产品已经难以满足客户全方位的需求。因此,近年来我行开始采用全产品营销方法,对庞大复杂的产品体系中的每一项产品都给予足够的关注,根据客户的需求制定产品组合营销计划,深入贯彻落实客户发展战略以及多元化领先者战略,坚持“以客户为中心、以产品组合为核心”的原则,采用“套餐+菜单”的模式,大力开展全产品营销,实现银行从“资金供应商”到“金融服务商”的转变。

这段文字意在说明:

A.

诺鑫银行要转变其在金融服务体系里的角色

B.

“以客户为中心、以产品组合为核心”将是我行今后的服务重心

C.

今后诺鑫银行的主打产品将是庞大复杂的产品体系

D.

企业客户的金融需求日益复杂,银行的传统单一产品已很难适应市场

第 72 题

单选题

为了抓住我国放宽银行业准入门槛的契机,宏宸宇达有意联合其他公司成立民营银行,进军金融业。据了解,目前银监会已正式批准五家民营银行的筹建申请,这批通过批准的五家民营银行不包括( )。

A.

深圳前海微众银行

B.

天津金城银行

C.

江苏华商银行

D.

温州民商银行

第 73 题

单选题

卢诚看了宏宸宇达的中期财务报告,下列关于中期财务报告的说法错误的是( )。

A.

企业中期财务报告至少应当包括资产负债表、利润表、现金流量表和附注,且其格式与内容应当与上年度财务报表一致

B.

中期财务报告应当被视为一个独立的会计期间,与年度财务报告采用一致的会计政策

C.

月度、季度或半年度财务报告均可称为中期财务报告

D.

企业取得的季节性收入,可以在中期财务报表中预计或递延

第 74 题

单选题

下列关于宏宸宇达财务报告中的语句,排序最合理的是( )。

①财务分析,就是要掌握和认识企业生产经营汇总资金运动的变化规律,为企业的财务管理和生产经营服务。

②由于业务种类、经营规模和管理水平的不同,企业对资金的需求和运用有着不同的特点和规律。

③企业的生产经营活动,随着业务种类的发展、业务量的大小等遵循一定的规律性。

④假如结构不合理,这可能产生的问题是什么?

⑤宏宸宇达这样的大企业,日常现金收支量大,这时财务分析就是要通过对相关数据进行分析从而掌握资金运动的这种规律性,做到心中有数,了解其流动资产、固定资产之间的合理比例应该是多少?

①财务分析,就是要掌握和认识企业生产经营汇总资金运动的变化规律,为企业的财务管理和生产经营服务。

②由于业务种类、经营规模和管理水平的不同,企业对资金的需求和运用有着不同的特点和规律。

③企业的生产经营活动,随着业务种类的发展、业务量的大小等遵循一定的规律性。

④假如结构不合理,这可能产生的问题是什么?

⑤宏宸宇达这样的大企业,日常现金收支量大,这时财务分析就是要通过对相关数据进行分析从而掌握资金运动的这种规律性,做到心中有数,了解其流动资产、固定资产之间的合理比例应该是多少?

A.

③⑤④②①

B.

③①②⑤④

C.

①②⑤④③

D.

①⑤④②③

第 75 题

单选题

卢诚仔细审核了宏宸宇达的利润表,利润表的基本要素不包括( )。

A.

利润

B.

收入

C.

成本

D.

负债

第 76 题

单选题

卢诚了解到,在此之前,宏宸宇达发行过一种债券,面值1000万元,票面年利率5%,期限3年,每年末支付一次利息,到期一次还本。已知发行时市场利率为6%,则该债券的发行价格为( )万元。

A.

965.56

B.

1133.65

C.

1150

D.

973.27

第 77 题

单选题

宏宸宇达打算上市后在海外投资一个贸易公司。假如该公司在将所获得的利润汇回国内时,其东道国实行了严格的外汇管制,以致该公司无法将所获得的利润如期汇回。此种情形下企业将会承受( )。

A.

转移风险

B.

投资风险

C.

系统风险

D.

主权风险

第 78 题

单选题

为了降低成本,宏宸宇达海外贸易公司在欧洲的业务,希望能采用人民币结算。卢诚向公司介绍,截止2014年10月,国内商业银行在欧洲共开设了四家人民币清算行。这四家人民币清算行所在地不包括以下哪个城市?

A.

卢森堡

B.

伦敦

C.

布鲁塞尔

D.

法兰克福

第 79 题

单选题

欧洲人民币清算行增至四家,人民币国际化提速,为宏宸宇达在境外的贸易提供了诸多便利。以下关于人民币国际化的含义,说法不正确的是( )。

A.

人民币现金可以在境外流通

B.

国际贸易中可以以人民币结算

C.

大多数国家持有人民币通货

D.

人民币在国际金融市场中作为计价货币

第 80 题

单选题

从推进整体业务布局的角度考虑,除了境外投资计划外,宏宸宇达还与一家国有企业甲、自然人乙进行协商,拟在境内共同投资设立一个合伙企业从事贸易业务。根据合伙企业法律制度的规定,下列选项中,错误的是:

A.

拟设立的合伙企业可以是普通合伙企业,也可以是有限合伙企业

B.

国有企业甲有权参与选择承办有限合伙企业审计业务的会计师事务所

C.

三方可以约定不经全体合伙人一致同意而吸收新的合伙人

D.

乙能以劳务作为出资方式

第 81 题

单选题

王总感谢卢诚提供的信息,并向他咨询这样一个问题:宏宸宇达和其他几家企业组成了一个以利润最大化为目标的卡特尔,现在又一家企业通过降价和增加产量而违约,那么包括宏宸宇达在内的其他企业最好的反映应该是什么( )。

A.

也降价并增加产量

B.

把违约企业开除出卡特尔

C.

提高价格以补偿失去的利润

D.

继续按协定的价格出售商品

第 82 题

单选题

【个人业务】

财务总监王总非常满意诺鑫银行提供的服务。在与他沟通中,卢诚了解到他有一些个人业务需求,而且很愿意在诺鑫银行办理。

王总的孩子将要出国留学,想向卢诚了解一下诺鑫银行的国际信用卡。以下是与信用卡相关的介绍,其中有语病的一句是( )。

财务总监王总非常满意诺鑫银行提供的服务。在与他沟通中,卢诚了解到他有一些个人业务需求,而且很愿意在诺鑫银行办理。

王总的孩子将要出国留学,想向卢诚了解一下诺鑫银行的国际信用卡。以下是与信用卡相关的介绍,其中有语病的一句是( )。

A.

长期以来,诺鑫银行信用卡业务始终秉持“我们先做到”的经营理念,坚持“规模化、精品化、全球化、专业化”的发展战略,以“一切为了持卡人”的服务理念为宗旨

B.

用信用卡付款对消费力强的人士来说有很多便捷之处,可以让专业买手直接对接国外品牌,付款方便,能够累积信用额度,更多高端的品牌也会主动找上门来提供服务

C.

奢侈品牌如果垄断了高端信用卡客户,那么,国内越来越多的大众品牌就会把目光投向普通额度的信用卡客户,这是一个还未大规模开发的市场

D.

对一些欧美品牌来说,一个客户是否拥有信用卡是一个很关键的消费档次划分点,也是消费信用的辨识方式,在寻找海外客户时,它们往往会首先考虑信用卡持有者

第 83 题

单选题

了解完国际信用卡,王总又向卢诚说起他侄女买房的事。王总的侄女叫王丽丽,想在诺鑫银行办理房贷,王丽丽男朋友的名下已经有了一套房产,但是离上班地点较远,他们想结婚后再市区购置一套房屋。卢诚先与王丽丽进行了电话沟通,并告诉她,自2011年起,我国强化差别化住房信贷政策开始实施,对贷款购买第二套住房的家庭,首付款比例不低于60%,贷款利率不低于基准利率的1.1备点。这一做法属于( )。

A.

窗口指导

B.

一般性货币政策工具

C.

选择性货币政策工具

D.

利率管制

第 84 题

单选题

听到这样的解释,王丽丽和男朋友决定在二人领证前以王丽丽的名字购房,这样能够享受首套房的优惠政策。此时正值开发商开展“购房惠装修”活动,为客户赠送建材商场的优惠券。现在王丽丽手里有两类优惠券,A类“满1000减200”、B类“满500减100”的优惠券。当天,王丽丽去建材商场购买建材,恰逢商场做活动,全场8.9折。王丽丽想买的两件建材价格分别是1299元、169元。商场活动规定,每个订单中优惠券和折扣不能同时享受。且优惠券最多只能使用一张。那么她至少需要付( )元的现金。

(结尾:本次沙龙活动不仅开拓了多家企业客户,宣传了诺鑫银行网上商城,还对客户关系进行了很好的维护。在与客户的接触中,诺鑫银行的专业度和服务质量获得一致认可。卢诚此次工作任务完成得很出彩。)

(结尾:本次沙龙活动不仅开拓了多家企业客户,宣传了诺鑫银行网上商城,还对客户关系进行了很好的维护。在与客户的接触中,诺鑫银行的专业度和服务质量获得一致认可。卢诚此次工作任务完成得很出彩。)

A.

1168

B.

1249.41

C.

1268

D.

1306.52

第 85 题

单选题

Bank of Nuoxin has been in good cooperation with Bank of Monsell in international business for long time. At the beginning of 2014, Nuosin planned to bring in some international financial products from Monsell. Xiangning in the blue team is told to prepare for the business negotiation.

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

We can learn from Paragraph One that ______.

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

We can learn from Paragraph One that ______.

A.

Bank of Monsell has a presence in all the continents in the world

B.

Bank of Monsell has over 7 million customers as of August, 2014

C.

as of August, 2014, Bank of Monsell has survived for over 190 years

D.

Bank of Monsell was founded with $250,000, but now its assets have reached $587 million

第 86 题

单选题

Bank of Nuoxin has been in good cooperation with Bank of Monsell in international business for long time. At the beginning of 2014, Nuosin planned to bring in some international financial products from Monsell. Xiangning in the blue team is told to prepare for the business negotiation.

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

The underlined word “unrelenting” in Paragraph Two here is closest in meaning to ______.

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

The underlined word “unrelenting” in Paragraph Two here is closest in meaning to ______.

A.

harsh

B.

never-ceasing

C.

unbelievable

D.

unforgiving

第 87 题

单选题

Bank of Nuoxin has been in good cooperation with Bank of Monsell in international business for long time. At the beginning of 2014, Nuosin planned to bring in some international financial products from Monsell. Xiangning in the blue team is told to prepare for the business negotiation.

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

Which of the following is NOT among the reasons why Bank of Monsell has survived many difficulties

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

Which of the following is NOT among the reasons why Bank of Monsell has survived many difficulties

A.

It delivers value to its customers.

B.

It integrates respect for the environment into its business growth strategies and practices.

C.

It contributes to the well-being of the communities where it does business.

D.

It creates opportunities for its employees.

第 88 题

单选题

Bank of Nuoxin has been in good cooperation with Bank of Monsell in international business for long time. At the beginning of 2014, Nuosin planned to bring in some international financial products from Monsell. Xiangning in the blue team is told to prepare for the business negotiation.

The passage following could help you know more about Monsell. And there will be 5 questions according to the passage. You should read carefully, then select the right answer.

Passage:

As one of North America’s leading and highly diversified banking and financial services organizations, Bank of Monsell was founded by a group of nine merchants in Canada on November 3, 1822 with an initial capital base of $250,000. Now with total assets of $587 billion, it has evolved into a team of over 47,000 talented and committed employees worldwide with a presence in London, England; Dublin, Ireland; Zurich, Switzerand; Munich, Germany; Hong Kong, Beijing, Guangzhou and Shanghai, Taipei, China; Mexico City, Mexico; Bridgetown, Barbados; Rio de Janeiro, Brazil; and Melbourne, Australia. In Canada alone, Bank of Monsell has over 7 million customers as of August, 2014.

From its establishment till now, it has survived the two World Wars and competition from many massive and strong financial institutions, due to its strength and the principles it has been sticking to. Over these decades its progress has been unrelenting, yet many of the essential organizational and strategic approaches remain.

In the first place, the bank puts continuous massive commitments to its customers, providing accessible, affordable banking and relevant products and services that make sense. Secondly, it continually invests in introducing innovative services, including cash management and nationwide processing of payrolls for businesses, and greatly improved convenience and choice for individual customers.

Then, it recruits talented individuals, and gives them the opportunities and support required to succeed, creating an equitable and inclusive workplace, one where all employees can bring their full potential to serve its clients and meet business goals of the bank.

Besides, with a good corporate citizenship, it reflects the values of the customers and communities they serve and ensures they deliver both business and societal value. This deeply rooted commitment can be seen with the $100 the bank gave to local hospitals in 1835 its first recorded charitable donation , the $10,000 donation to McGill University in 1911, the $3 million donation to University of Toronto to establish the Bank of Monsell National Scholarship Program in 1996 and the $1 million donations given in 2005 to Toronto’s Hospital, etc.

The bank has as well formulated a code of business conduct and ethics, called First Principles which sets out rules and policies that help all its Financial Group employees do the right thing when dealing with the clients, suppliers, other stakeholders, and each other. First Principles applies to all directors and employees of Bank of Monsell and its direct and indirect subsidiaries worldwide. Last but not least, the bank has also put enormous attention to the training programs for its employees. In 1991, it even built a training center at an investment of $40 million.

Bank of Monsell covers a large number of services and offers a wide range of investment products, such as treasury services, wealth management, capital raising, institutional investing, market risk management and international banking. It also provides advisory services for mergers & acquisitions and restructurings, as well as industry-leading research, sales and trading.

The wealth created by Bank of Monsell is widely shared. In 2012, its revenue was $16,130 million. Of this amount, approximately 33% went to employee compensation, 27% went to suppliers and 5% went to its provision for credit losses. Of the remaining $5.711 million, 28% went to governments in the form of income taxes and other levies and 72% was returned to its shareholders.

In its early days, it provided one of Canada’s first widely-recognized and circulated currencies and was instrumental in providing capital to new businesses across the continent, financing the building of Canada’s infrastructure, and developing the economy, playing a major and continuing role in the development of the country. Almost two centuries later, as one of Canada’s pre-eminent financial institutions and a significant presence in the United States and world markets, it is still playing a critical role in the financial affairs and success of the clients, continuing to evolve and meet new opportunities to give clients the products, services and expertise they need to meet and exceed their financial goals.

If the revenue created by Bank of Monsell is $20,000 million in 2014, which of the following statements is TRUE